In August of 2013 Google suffered a rare two minute outage. During that infamous two minutes 40% of the web went dark. Forty percent! This event was a clear reminder of the ultimate control Google has over the web and web traffic.

Since the early days of the web, control of discovery and web traffic has been the focus of many. In the mid- to late-nineties, such control was in the hands of ISPs such as AOL and Earthlink. In the late nineties, the control shifted to portals with Yahoo and its MyYahoo service in the lead position. (I recall a conversation in 2000 with a former colleague of mine asking for an introduction to the MyYahoo team: “If you are not on MyYahoo, you simply don’t exist. It costs too much to promote your site.”) In the early to mid 2000s, Google dis-intermediated Yahoo and stole that position with Search and AdWords. Google has since reigned supreme over web discovery, organic and paid traffic acquisition. An entire industry has been built around SEO and SEM and both of these acronyms have become synonymous with the name Google.

Then came mobile and its apps. In just over five years since the launch of the Apple AppStore, apps have taken the mobile industry by storm. Today, 86% of time spent on mobile devices is spent inside applications, with just 14% left for the mobile web. App discovery has been a major challenge over the past five years. That led to the fast rise of the paid App Install market. In fact, Marketers are expected to spend over $2.4 billion USD in the US alone to get their apps noticed.

Discovering relevant content and services within apps has also been a big challenge. Consumers want such a service. As an example, if a consumer is searching for a flight to Las Vegas, in an ideal scenario the phone or discovery service would launch whatever flight booking app is installed on the phone and send the consumer directly to the reservations page. But apps (alongside the content and services in them) can’t be crawled. They are not just about index and links, and hence are hard to “page rank.” As a result it is difficult for a search engine to discover apps and offer consumers an entry point.

Consumer behavior on mobile is very different than the desktop web. The de-facto behavior on the web is to launch the browser to google.com, type a sentence and be re-directed to content. The de-facto behavior in mobile is to launch an app (previously installed on the device) and enjoy the comprehensive experience offered within it. You are rarely, if ever, linked out to a mobile webpage from an app or sent to another app. Each experience is essentially an island unto itself, completely reliant on the consumer to come ashore.

The industry and some major mobile players are looking to solve this problem and the battle is raging for the “gateway” for mobile apps, content and services. In short, the Google position for mobile is up for grabs and billions of dollars are at stake.

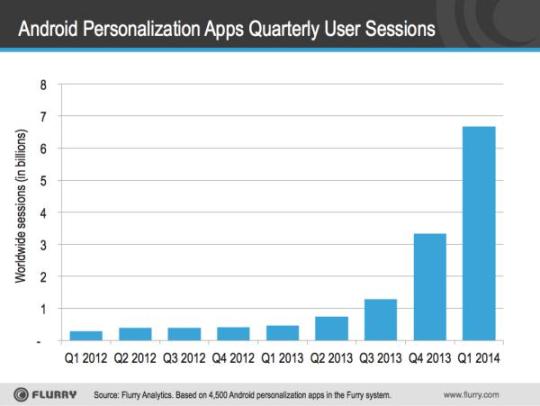

At Flurry, we are in the middle of that battle and have built solutions to help apps get discovered and acquire traffic. We watch the space very carefully. We have seen a lot of companies, large and small, try to solve this problem: Apple with Siri, Google with Search and Google Now, Facebook with App Install and App Conversion Ads, and myriad others. But recently we have been most intrigued by Android Personalization apps, also called Launchers, especially after the creation of Facebook’s Home and Yahoo’s acquisition of Aviate. So we have taken a closer look at this category and the chart below shows the very fast adoption and usage of these personalization apps on Android.

The majority of these apps offer a personalized homepage for Android, and do some form of app discovery and app launch.

There are over 4,500 apps in this category on the Flurry platform and the data shown represents the aggregate usage of these apps. It shows the number of app sessions recorded by Flurry in apps in the Android Personalization category, by quarter, since the beginning of 2012. The growth in that category is astonishing. In fact, Q1 2014 (and the quarter is not over yet) usage is higher than all of 2013. While the cumulative reach of these apps is still relatively small (30 million monthly users in the US), the usage growth is eye catching.

This data set is telling us something. In fact, this data set is telling us something big. It is telling us that consumers are eagerly waiting for an innovative service that help them discover apps, content, and services around them in a personalized way. While the numbers are still small, the fast adoption of these apps can’t be ignored. The battle for the mobile homescreen has begun. The battle for the “Google position of mobile” has entered a new phase, and it is “must-win” battle for many.