Last year, Flurry reported that iPhone and iPod touch game sales surged from 2008 to 2009. From a standing start, and in just one year, iPhone games captured 5% of the mature U.S. video game market. A year later, we revisit how the increasing popularity of iOS (iPhone, iPod touch and iPad) and Android games continue to increase their U.S. video game market share. With an additional year of trend data, the magnitude of disruption is increasing, in particular within the portable gaming category.

For this year’s report, Flurry once again leverages publicly available market data in the news, released by companies such as the NPD Group (e.g., Gamasutra’s Behind the Numbers series). We combine this data with our own estimates of game category revenues from iOS and Android devices. Flurry Analytics, the company’s free mobile app analytics service, tracks more than 12 billion anonymous, aggregated use sessions per month across more than 80,000 applications. Of this, nearly 40% of all consumer app sessions are spent on games.

For 2010, we expanded our iPhone and iPod touch numbers to include revenue delivered by tablets and Android devices. When running this analysis a year ago, the iPad had not yet launched and Android gaming revenue from 2008 and 2009 had not yet contributed enough revenue to meaningfully affect industry market share. For the sake of a consistent year-over-year comparison in all other aspects of this analysis, we continue to exclude retail PC game revenue, and once again do not include online digital game sales.

Apple and Google Platforms Push Forward into Video Gaming

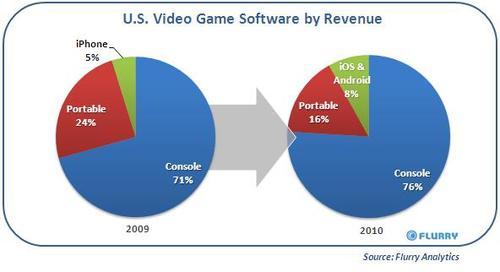

From 2009 to 2010, iOS and Android game sales increased from 5% to 8% market share within the U.S. video game market. Specifically, we estimate that iOS and Android game revenue increased from $500 million in 2009 to more than $800 million in 2010. Of this, the significant majority of revenue was generated by iPhone games. And while we do not include retail PC game revenue in our total snapshot, which we estimate was $700 million in 2010, it’s worth noting that smartphone and tablet game revenue surpassed the U.S. PC game category for the first time in 2010.

Studying the chart above, console and smart-device games have increased at the expense of portable gaming. Overall, total U.S. game revenue from 2009 to 2010 is relatively flat, totalling $10.4 billion and $10.7 billion, respectively. However, while console game revenue increased slightly, from about $7.4 billion in 2009 to $7.8 billion in 2010, the combination of declines in portable gaming software and a jump in smart-device app sales has squeezed the portable game category down from 24% market share in 2009 to just 16% in 2010. It’s clear that prolific intalled base gains by Apple and Android devices, low priced games (including a very robust free-to-play model enabled by in-app purchases) and seamless digital distribution to games on devices so near to consumers 24-hours-a-day, is driving potent industry-disruption.

Over 2011, we expect to see continued and significant smart-device game growth fueled by the recent launch of iPad 2, iPhone coming into distribution on Verizon, the expected release of iPhone 5, a relentless expansion of Android devices by leading OEMs across all major U.S. carriers, and Google’s enablement of in-app purchase billing, a proven key driver in iOS game revenue.

U.S. Portable Gaming: Mario’s Burning Platform

Recently, Nokia CEO Stephen Elop, passionately described a burning platform Nokia had itself set ablaze, largely as a result of its own strategic choices. Allegorically, despite Nintendo CEO Satoru Iwata’s stated concern that “these [mobile] platforms have no motivation to maintain the value of gaming” during his keynote at the most recent GDC conference, Nintendo may also be struggling with its own burning platform: Nintendo DS. Let’s look at the numbers.

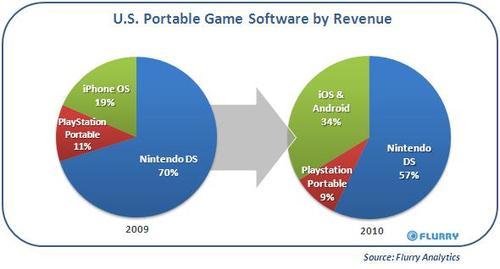

From 2009 to 2010, iOS and Android game sales have spiked significantly, resulting in nearly a doubling of their market share. With both Nintendo DS and Sony PlayStation Portable shrinking in sales, while smart-device game sales simultaneously grew by more than 60%, iOS and Android games now represent more than one third of the portable game category. The net effect is that the U.S. portable gaming category, as we define it, has declined from $2.7 billion in 2009 to roughly $2.4 billion in 2010.

Wedbush Morgan Securities video game analyst, Michael Pachter, points out that the “onslaught of $1 games is going to continue” and that “[Nintendo and Sony] are going to have to share the market with Apple and Android.” Our numbers quantify just how much. Further, as iOS and Android continue to change the paradigm of casual gaming, the battle between Nintendo against platforms such as iOS and Android will intensify. Mario may indeed be standing on a burning platform.