In 2018, Apple announced they would no longer publicly share the number of iPhone devices sold each quarter. Instead, they would focus on quarterly revenue as a way to include their growing services and subscription business. In the two years since this announcement, Apple has expanded its services business to seven offerings, including Apple Fitness+ and Apple One announced earlier this week. With this new revenue stream layered on top of the iPhone, Apple has been reducing the minimum starting price for the iPhone to expand their footprint and sell more services. For this report, we analyzed the impact of Apple’s low price devices on iPhone sales worldwide.

Flurry Analytics, part of Verizon Media, is used in over 1 million mobile applications to provide aggregated insights across more than 2 billion active devices every month. We include only devices sold directly through Apple’s retail channels so as to exclude devices that are resold through secondary markets. Let’s first review new iPhone activations in the second quarter of 2020 when Apple launched the iPhone SE (2nd Generation).

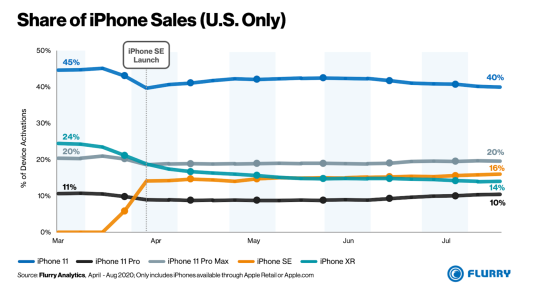

In the chart above, we plot the percent of new device activations by week in the U.S. We focused on the U.S. market since the iPhone SE’s international launch was much more staggered and doesn’t provide as clear of a picture of cannibalization. During its launch week in the U.S., the iPhone SE captured 14% of all Apple iPhone sales. At the same time, Apple’s other lower priced iPhone 11 and iPhone XR models saw sales declines of 5 and 4 percentage points, respectively, very likely due to consumers choosing the iPhone SE. Apple’s higher priced models, the iPhone 11 Pro and iPhone 11 Pro Max, experienced only a slight dip during the iPhone SE launch week, and have since recovered their market share.

By all accounts, the iPhone SE launch was successful, accounting for 14% of Apple’s total sales during its launch week. It’s also noteworthy that this took place in a global pandemic. To understand whether their sales were incremental or cannibalizing the iPhone XR and iPhone 11, we took a look at growth outside the U.S.

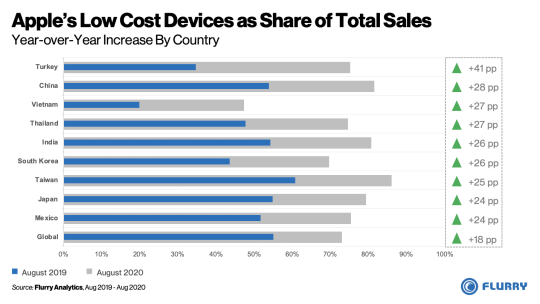

In the chart above, we list the countries where Apple’s lower priced devices are growing the fastest. In August 2019, we consider the iPhone XR Apple’s only low-price device. And in August 2020, we consider the iPhone XR, iPhone 11, and iPhone SE as low-price devices. The blue bar represents the August 2019 share of sales of the iPhone XR. The gray bar represents the August 2020 share of sales of the iPhone XR, iPhone 11, and iPhone SE. For example, in Turkey during August of 2019, the iPhone XR made up 35% of all iPhones sold through Apple’s retail channels. One year later, in August 2020, the iPhone XR, iPhone 11 and iPhone SE combined accounted for 75% of all iPhones sold through Apple in Turkey. Countries are sorted in descending order of year-over-year growth shown by the embedded table on the right of the chart. A few observations stand out:

- With the exception of Vietnam, more than two-thirds of all Apple August 2020 retail sales were generated from lower price devices.

- The top 8 growing countries for low-price Apple devices are in Asia. Samsung and several Chinese smartphone manufacturers currently dominate in Asia, but Apple appears to be making strong gains with its lower-priced devices.

- Several countries including India, Brazil, Mexico, and Russia have relatively low smartphone penetration, providing Apple an opportunity to increase share in emerging markets.

Now that we’ve shown that Apple’s low price devices are making up a larger share of Apple’s total sales in many international markets, let’s look at how low-priced devices may be increasing overall net Apple smartphone adoption.

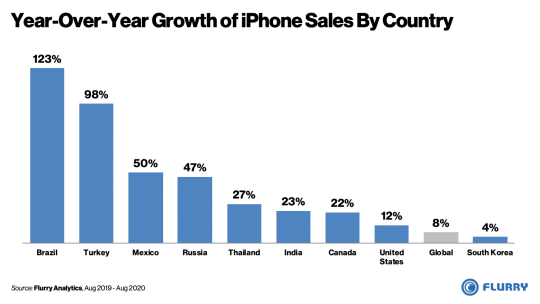

In the chart above, we show the fastest growing iPhone countries, based on year-over-year iPhone sales through Apple retail channels. For reference we include the global growth rate in gray, at 8%. Growth has been strong, especially in certain Android dominated markets across Latin America and Asia. For example, Brazil and Turkey have both approximately doubled the number of iPhone sold with growth rates of 123% and 98%, respectively. And many of these countries still have relatively low smartphone penetration, which positions Apple to pick up share as adoption rates increase.

Based on the increased sales velocity of their low price devices, combined with an overall increase in total sales, Apple is driving growth through lower priced devices while maintaining high end device sales volume. However, the more Apple releases budget devices, the more it could diminish its perception as a luxury brand. The trade off between selling fewer, premium devices at high price points and aggressively driving growth at lower prices points will strain its brand positioning. Make sure you subscribe to the Flurry blog and follow us on Twitter and LinkedIn to stay up-to-date on the latest smartphone adoption trends.

iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

The Flurry blog (https://www.flurry.com/blog/) is an independent blog and has not been authorized, sponsored, or otherwise approved by Apple Inc.