In 2012, there were approximately 1.4 million applications in the Google Play and App Store, combined. Now, with over three million apps across the App Store and Google Play, users have more app options to choose from than ever before.

This in mind, Flurry decided to revisit our App Loyalty Matrix for the first time since 2012 to understand how users are engaging in apps across category. When we last did this analysis, Flurry had a footprint of 230,000 apps. And just like the phenomenal growth we’ve seen in the app stores, Flurry now tracks over 830,000 applications.

Expanded category growth has led developers to compete to capture users’ attention and retain their interest. Our analysis shows that users are spending less time and returning less frequently to apps across all categories.

The Analysis

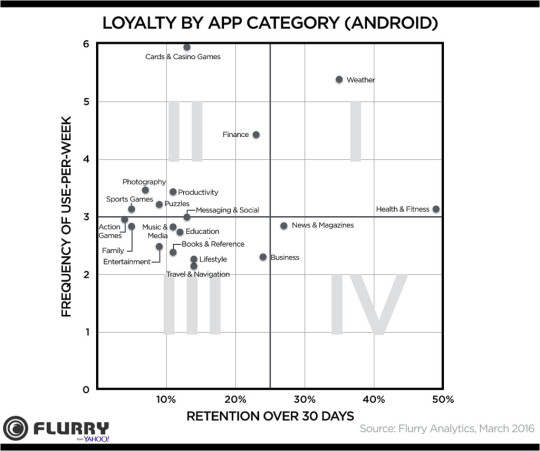

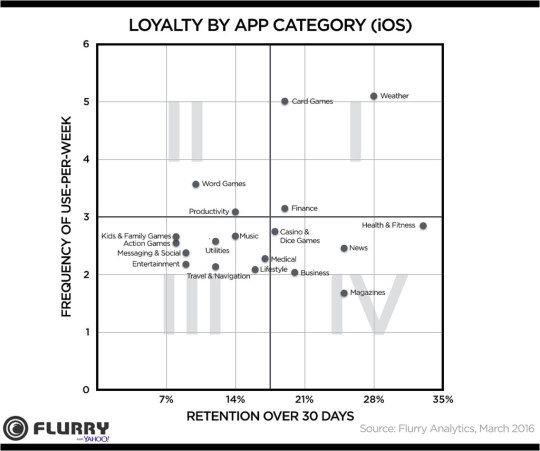

Our matrix plots application categories by how often they’re used compared to how long consumers continue to use them over time. Specifically, we plotted the median 30-day retention rate of app categories on the x-axis against the median frequency of use per week on the y-axis by App Store. For categories, we started by taking the categories defined by Apple and Google and in cases where a cluster of applications within a parent category showed meaningful usage differences, we created a sub-category.

Quadrant I includes apps that are used the most frequently and to which consumers are loyal over time. These apps have user bases that find value in the apps throughout the day and week. Not surprisingly, Weather and Finance apps fall within this category. Users rely on these apps every day, many times a day, to get updates to the weather and stock quotes. For the first time ever, we’ve found that Health and Fitness apps in both the iOS and Android store fall within or very close to Quadrant I. After hundreds of years of diet fads, perhaps the app industry has created a viable healthy living solution!

Quadrant II is comprised of apps that are used intensely, but for finite periods of time. A number of Game sub-categories fall within quadrant II, as well as productivity apps in both the iOS and Play stores. Although these categories may initially grab a user’s attention, it is becoming increasingly more difficult to maintain their attention. Utilizing push notifications to re-engage users and iterating and enhancing frequently will allow apps in this quadrant more opportunity to maintain their audience. A full breakout of the Gaming sub-category analysis can be found below.

Quadrant III is made up of apps that have high churn and infrequent use. Similar to our 2012 analysis, a large majority of apps fall within this area. Users are more comfortable than ever before to download an app and give it a try. Although some of these app categories provide immediate benefits with little incentive to return, there are many things that app developers can do to increase adoption and move out of this quadrant. Improving user onboarding and the zero state of your app will encourage adoption. Apps are more social than ever before and building in social functions such as content sharing and promoting user driven community adoption helps you build an engaged audience.

Quadrant IV is made up of apps that have low frequency of use, but a loyal user base. Across both iOS and Android, the News and Magazines categories fall within Quadrant IV. Users develop habits around utilizing the apps in these categories. If apps within Quadrant IV want to increase frequency, they can utilize alerting functions to engage users throughout the day.

There are many strategies for monetization which all apps, regardless of the quadrant they fall within, can employ. While native and video ads have proven to work within all apps, they are particularly great for apps with higher churn (Quadrant II & III) to take advantage of their bursts of users. Apps with higher retention rates (Quadrant I & IV) are more likely to succeed with building in ads and monetizable experiences and employing in-app purchases.

With the continued diversification of app usage across categories, and the year-over-year time spent on smartphones increasing exponentially, the app ecosystem is not only competitive, but cluttered as well. Now more than ever before, developers need to focus on building sticky product and grab user’s attention.