Developers devote a lot of attention to the time immediately after an app is launched. How quickly is it growing? Will it go viral? How is it ranking in app stores? While that launch period is critical, managing apps well throughout their entire lifecycle means also paying special attention to what happens after an app peaks. Does it decline precipitously or manage to hold much of its audience for a long time?

We explore the post peak phase of the lifecycle of mobile apps using the concept of a half-life, which for purposes of this analysis we define as the point at which an app’s monthly users (MAU) have declined to 50% of their lifetime peak.

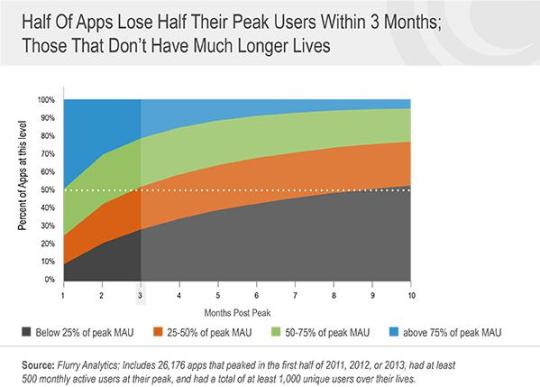

We start by looking at the overall rate of decay for 26,176 apps that peaked in the first half of 2011, 2012, and 2013. (That allows enough time for decay even for apps peaking in 2013 and also controls for the time of year in which the app peaked.) The chart below shows what proportion of apps were at what percentage of their peak MAU in each of the first ten months after they peaked. Apps in the gray band fell below 25% of their peak MAU by the month indicated, apps in the orange band had fallen below 50% but were still above 25%, apps in the green band were below 75% but above 50%, and apps in the blue band were above 75% of their peak MAU in the month shown in the horizontal axis.

As shown in the chart, decay is fairly rapid in the first few months post peak. A quarter of apps fall below half of their peak MAU the month after peaking (see the top of the orange band in the chart). That percentage grows to 43% in the second month post peak. In the third month post peak, just over half (52%) of apps fall below half of their peak MAU. The fourth month post peak is a critical benchmark: From this point on, MAU decay continues, but at a much slower rate (note the flattening of the color bands after the 4th month).

The overall pattern of app user decay has been remarkably stable over the past three years, but there is variation based on app category, size, and operating system. The table below shows median app half-life for apps within each grouping. This corresponds to the month in which the top of the orange band and the bottom of the green band intersect at the 50% line in the previous chart.

The biggest influence on the rate of app decay is category. Apps in utilitarian categories such as news and health decay at a much slower rate than apps in the more trend-driven games and social categories.

On average, apps that peak at 10,000 MAU or more enjoy a half-life that is two months longer than apps that don’t reach that level.

iOS apps typically reach their half-life a month later than Android apps.

Many developers give a lot of thought to how to grow their apps, but we suspect fewer devote the same attention to managing their app’s decline. In some ways, this is analogous to people looking after their health as they age. The right habits can prolong longevity. In the case of apps, that means paying close attention to user retention and re-engagement – particularly as MAU growth begins to plateau and decline.

Those first few months post peak are key since the rate of decay levels off after about four months. More than half (56%) of apps that manage to hold more than half of their peak users for the first four months after they peak are still holding on to more than half of them ten months post peak. That could have a sizeable revenue impact. For example, consider an app that peaks at 100,000 monthly average users and has average revenue per user per month of $2.50. Holding at least half of those users through month four means the app has a 56% chance of holding them for another six months and that translates into revenue of $750,000 (100,000 users* half of them remaining *$2.50 per user per month * 6 months).

Just as actuarial tables help insurance companies anticipate costs, understanding typical app decay patterns can help developers and those who fund them anticipate app revenue streams. For example, assuming similar development costs and average revenue per user per month, a game app would need to peak with many more active users than a news app to have the same profit potential since its life can be expected to be a lot shorter. And it pays to invest in growing MAU for any app to the highest peak possible since that is also likely to mean the app will enjoy a longer half-life.