Over the past several years, Chinese smartphone manufacturers have invested heavily in the Indian market. Armed with sizable marketing budgets and quality devices at competitive prices, Chinese OEMs dominated new device sales. However, with newly escalating political tensions between the two countries, Chinese smartphone manufacturers suddenly find themselves facing a boycott of Chinese-made goods. With this potential disruption of Chinese OEM momentum, the door is reopening for Samsung to regain lost share, Apple to now grab a toe-hold with its more affordable iPhone SE 2, and for Indian manufactures to regroup against the swift momentum generated by Chinese manufacturers.

In this report, we’ll show the rapid rise of Chinese OEMs in India over the last few years and who could benefit from the next phase of Indian smartphone growth. Flurry Analytics, owned by Verizon Media, is a mobile app analytics provider with insights across 1 million mobile applications globally, with strong coverage in India. For this analysis, we studied shifts in new device activations across smartphone OEMs in India. Let’s first review OEM share by country of origin.

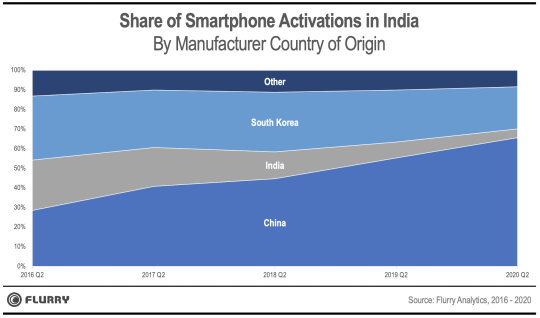

In the chart above, we categorize manufacturers by their countries of origin: China, India, and South Korea. South Korea’s share is almost entirely made up of Samsung devices. India has several local brands, with Micromax being the largest. China also has several brands, including Xiaomi, vivo and Oppo. We’ve bundled all other international manufacturers into the Other category, including Apple, Motorola, and Nokia, among several others. Note that Apple has a very small share of the smartphone market, as 97% of all smartphones in India are Android devices.

In 2016, 34% of all devices activated in India were Samsung devices, putting the South Korean OEM comfortably in the number one spot. India’s OEMs captured more than 25% of all new devices, and Chinese manufacturers controlled 29%. Over the next four years, however, Chinese manufacturers drove remarkable growth, capturing 66% of all new device activations by 2020. During this same period, Indian manufacturers’ share of new device activations plummeted to just 4%.

The smartphone market in India also grew significantly over this time period. Between 2016 and 2020, the number of new device activations increased by 1.4X. To put this in perspective, for a country the size of India this means that over 100 million new devices entered the market. Chinese OEM growth came from both attracting new, first-time smartphone users as well as taking share from Indian competition. Let’s now review how device activation shifted by manufacturer over the last four years.

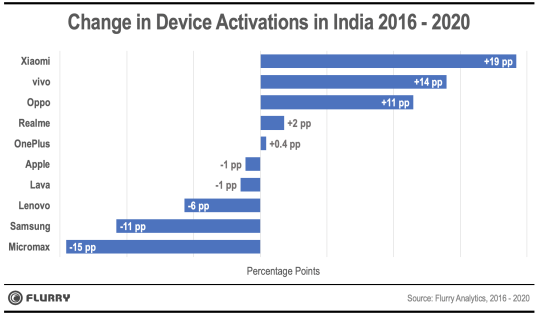

The chart above shows the change in new device activations across manufacturers. We compare the share of new devices activated in 2016 versus 2020. Note that only Chinese OEMs saw an uptick in smartphone adoption. In 2016, India’s Micromax was the second most activated device, only behind Samsung. Since then, Micromax device activations have dropped by 15 percentage points. More than anything, this chart highlights the gains that Chinese manufacturers have made at the expense of Micromax and the other Indian manufacturers.

Samsung, meanwhile has remained steady. Although its new device activations have decreased by 11 percentage points over the past four years, Samsung continues to experience year-over-year growth – just not at the same rate as their Chinese competition. Samsung devices are generally priced higher than their Chinese peers, putting them in a more premium category. It appears Samsung’s brand has not only withstood the first wave of Chinese competition in India, but that it may also benefit from the current political climate.

As political tensions have increased between India and China, both the people of India and its government have found ways to express their disapproval. The growing social movement to boycott Chinese-made products continues to gain momentum among the people. And India’s government has banned 59 Chinese-developed mobile applications that they claim are a threat to the “sovereignty and security of India.” With India’s smartphone market far from saturated, this tension creates opportunities for Indian manufacturers, Samsung and Apple. We’ll continue to monitor smartphone adoption rates by manufacturer in India and keep you updated about any important developments.