Through applications using Flurry for analytics reporting, Flurry can detect and count unique devices in the market such as Google Nexus One and Motorola Droids. Because applications embedded with Flurry have been downloaded to over 80% of all iPhone OS and Android devices, Flurry is able to make reliable estimates about total handset sales.

Earlier this year, Flurry estimated both first week and first month sales of Nexus One Sales compared to Motorola Droid and the first generation iPhone, among others. Despite the fact that the Google Nexus One is the most advanced Android handset to date, and enjoyed substantial buzz leading up to its release, the launch has been overshadowed by lower than expected sales. In our previous reports we offered several possible reasons including unconventional choices in marketing, pricing and distribution.

So, why 74? Simply put, according to Apple, the original iPhone reached 1 million units sold in that many days. And since the Nexus One launched on January 5, we’ve had Friday, March 19 (aka day 74) circled on our calendars. The comparison is interesting because the iPhone and Nexus One each represent Apple and Google’s first fully branded handsets, respectively. We add the Motorola Droid as a point of comparison, and because it’s the fastest selling Android phone to date.

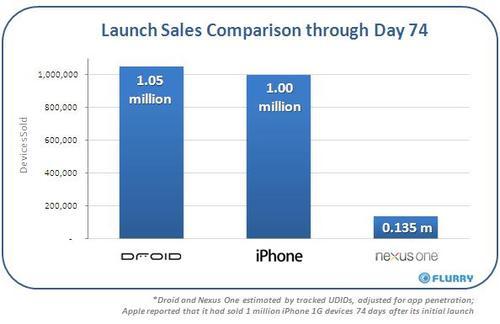

The chart below compares the sales results through each of their respective first 74 days. The launch dates were: iPhone, June 29, 2007; Droid, November 5, 2009; and, Nexus One, January 5, 2010. Please note that we forecasted the last few days of Nexus One’s first 74 days sales based sales of the first 70 days we tracked at the time of writing this report.

Inspecting the graph, it’s immediately clear that Nexus One sales continue to pale in comparison to iPhone 1G and Motorola Droid, with each besting Nexus One sales by roughly 8 times over the same time period.

At the same time, an interesting side-story is that the Motorola Droid edged out iPhone 1G over the first 74 days, coming in at just over one million sold through, by our calculations. This was surprising enough that we re-ran our estimates several times and still came up with the same results. Thinking about the differences associated with each launch (operator, year, etc.), we believe there are three underlying drivers of Droid worth keeping in mind compared to the other two handsets:

1. Consumer Perception & Demand: Motorola Droid launched over 2.5 years after the iPhone 1G. (Nov 2009 vs. July 2007). When the iPhone launched, consumers’ concept of a mobile computing device as we now understand it, was very different. Since then, Apple has spent millions of dollars training and educating consumers about capabilities of such a device, which was no small feat especially after its first foray into the handset business (Motorola ROKR E1 in 2005). Until the iPhone was introduced, most consumers, especially in the U.S. had thought of their phones as, well, just phones. Finally, it’s worth noting that the Motorola Droid could be considered Android’s “third generation” handset, which benefited from generated awareness by preceding G1 and MyTouch 3G handsets.

2. Relative Subscriber Bases: Droid launched on Verizon, a larger network with more subscribers than AT&T, especially when considering AT&T’s 2007 size (63.7 million at the time of iPhone launch) versus Verizon’s 2009 size (89 million at the end of Q3). Additionally, there was pent up demand among the Verizon subscriber base for an iPhone killer, which is exactly how Verizon positioned the Droid. Finally, Verizon backed the launch with advertising support of at least $100 million.

3. Holiday Season Sales: Droid benefited from launching on Nov 5 and having its first 74 days lifted by the holiday season, which is the highest selling period of the year for handsets. Neither iPhone 1G nor Nexus One’s first 74 days spanned a holiday period.

As Google and Apple continue to battle for the mobile marketplace, Google Nexus One may go down as a grand, failed experiment or one that ultimately helped Google learn something that will prove important in years to come. Apple’s more vertically integrated strategy vs. Google’s more open Android platform approach offer strengths and weaknesses that remind us of PC vs. Mac from the 1980’s. A key difference this time around is that Apple is enjoying much more 3rd party developer support, whose innovative applications push the limits of what the hardware can do. Ultimately, however, developers support hardware with the largest installed base first. For Android to make progress faster, from a sales perspective, it needs more Droids and fewer Nexus Ones going forward.