There is a lot riding on the Motorola Droid. Verizon is looking for an answer to the iPhone, which has driven enviable data ARPU growth for AT&T. According to Rita Chang of Ad Age, the Droid is supported by a $100 million integrated marketing campaign, the largest in Verizon history, running through the end of 2009. Google’s long-term bet on mobile, underscored by its recent $750 million offer to purchase Admob, demands that the Android OS propagate. Meanwhile, HTC enjoys an early mover advantage with its G1 and 1.5 generation of Android handsets. Finally, several more leading OEM’s have pledged to support Android, with as many as 100 handsets scheduled to ship in 2010. In short, the once dominant, now reinvented Motorola has little room for error.

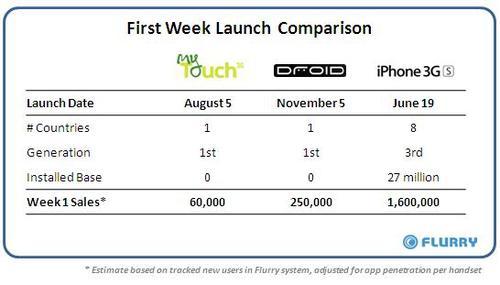

Through its analytics service, Flurry monitors usage of over 10,000 developers’ applications on iPhone and Android. In total, Flurry tracks applications on approximately two out of every three unique iPhone and Android handsets in the market, including over 15,000 million user sessions per day. To estimate first week sales totals for the myTouch 3G, Droid and iPhone 3GS, Flurry detected new handsets within its system, and then made adjustments to account for varying levels of Flurry application penetration by handset. Flurry additionally cross-checked its estimates against Apple actual sales, released for the iPhone 3GS, which totaled one million units sold over the three days of sales, Jun 19 - 21. Flurry first week sales estimates can be found in the table below.

While Flurry estimates Apple sold approximately 1.6 million 3GS units over its first week of sales, it is important to note that Apple simultaneously launched its device across eight countries (U.S., Canada and six European countries), while the Droid launched only in the U.S. Additionally, the iPhone commanded a strong installed base of over 25 million at the time the 3GS launched. Of those, over 6 million were first generation iPhone users who were expected to upgrade to the 3GS. Taken in this context, Droid sales of 250,000 units during its first week from a standing start and in just one country, is a strong result for Motorola and Verizon. Also, by Flurry’s measurement Android does have an edge over iPhone app usage, with the average Android session length at four minutes vs. two minutes for iPhone apps.

With its first week showing, the Droid is the fastest-selling Android phone to date. Compared to the myTouch 3G on T-Mobile, Droid outsold it by more than four times. Of course, Verizon has nearly 90 million subscribers to T-Mobile’s 34 million and Verizon has shown a willingness to outspend previous carriers with its $100 million campaign. With Motorola forecasting its own Droid sales at one million through the end of the year, that equates to a cost per acquisition of $100 per handset sold. Verizon’s aggressive campaign coupled with its 3G network advantage in key, populous regions of the country like the Northeast positions the Droid as a legitimate challenger to the iPhone.

While iPhone continues to dominate the Smartphone market overall, each subsequent Android handset launch increases competition for Apple. Furthermore, Flurry has monitored a sharp increase in new Android project starts by application developers within its system, a 94% jump in October compared to September. The launch of Droid signals the beginning of a viable platform alternative to the iPhone as Android builds critical mass. As major companies continue to vie for a piece of the exploding Smartphone market, the consumer has never had more choice and innovation in the mobile industry. With Droid, Motorola has raised the bar for Android handsets, contributing to an ever-growing base of Android handsets upon which applications developers can build a business.