Each month, Flurry leverages its data set collected from iPhone, Android, BlackBerry and J2ME applications to identify, study and share industry trends. Flurry tracks over 20,000 live applications and over 2 billion user sessions each month. Applications that include Flurry Analytics have been downloaded to more than 80% of all iPhone, iPod Touch and Android devices. Additionally, each day, approximately one of out every five downloaded applications from the App Store and Android Market include Flurry Analytics. The Pulse report is generated in the first half of each month, looking back at data up through the previous month. Different than other reports that provide updates to the same set of statistics each month, Flurry explores different business themes and topical issues relevant to mobile developers and other industry players.

I. Money Talks: App Store vs. Facebook Platform

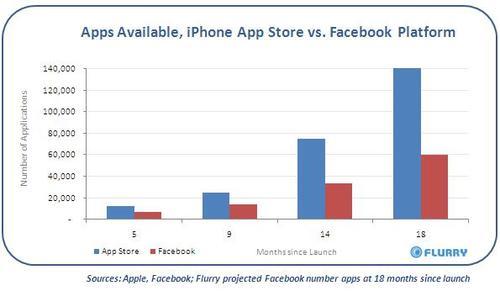

Since the App Store launched in July 2008, 35,000 unique companies have released applications, which translates to 58 new companies launching apps each day. This appears to be the largest amassing of 3rd party developer support by any development platform in such a compressed timeframe. For example, comparing the number of applications created for the Facebook platform to the App Store over their respective first 9 months, Apple boasted 25,000 apps to Facebook’s 14,000. Comparing respective growth in apps after 14 months, Apple had widened its gap to 85,000 apps over Facebook’s 33,000. At the App Store’s 18 month mark, reached this January, the number of iPhone apps was reported to have exceeded 140,000 compared to the 60,000 we estimate Facebook had reached over its first 18 months. We believe the difference in growth rates can be attributed to the App Store providing better monetization possibilities for application developers than Facebook did through its first 18 months. Developers, like all rational companies, pursue markets where the path to revenue generation is clear.

II. iPhone Developer DNA: O Brother, Where Art Thou (from)

Thinking about the sheer number of developers with applications in the App Store, we had the practical question: where’d they all come from? It’s as if they’ve appeared over night. Has Apple created a magical new economy for application development start-ups, attracted existing content creators and brands from other platforms, or both? In this report, Flurry examines the genealogy of iPhone application content; that is, their platforms of origin. This sheds light on the mix of skills, motivations and frames of reference different content providers bring to the App Store economy, and which are winning.

To generate a sample that allowed us to compare across categories and pricing models (paid, ad supported, micro-transactions, etc.), Flurry created an index that took into account application rankings across both top 100 paid and top 100 free categories, additionally adjusting for frequency of use and user retention over time. Doing so enabled us to evaluate a free application’s ability to retain a user base, important for generating advertising revenue past the download. Based on this index, we generated a list of 200 applications and identified six distinct “heritage” categories:

- Native iPhone: Companies founded to create applications for iPhone (e.g., ngmoco, PageOnce)

- Traditional Media: Companies established on Film, TV, Print and Radio (e.g., Disney, TBS, NYT)

- Mobile: Companies having started on J2ME, BREW, BlackBerry, etc. (e.g., Digital Chocolate, eBuddy)

- Retail & CPG: Brick-and-mortar companies or ones that manufacture goods (e.g., The Gap, DKNY, Kraft)

- Online: Companies who began on the web including e-Commerce, social networks, online gaming, streaming music, etc. (e.g., Google, eBay, Facebook, Pandora, PopCap, Zynga)

- Traditional Gaming: Video game companies from console, portable or PC (e.g., EA, Activision).

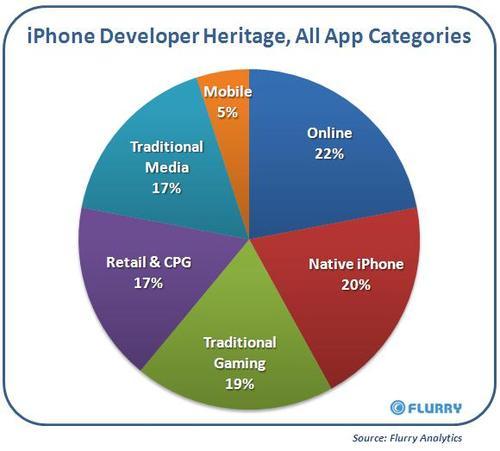

The pie chart below shows a breakdown of developers making top applications based on their heritage:

On any new media platform (or channel), entrepreneurial companies enter early in an attempt to establish themselves before a wave of large brands enters the space. At the same time, bigger companies typically take a wait-and-see approach when evaluating new channels and only invest after the ROI for the channel is proven. This combination of small and big company behavior, when evaluating new platforms/channels, creates the window for entrepreneurs to enter early and potentially disrupt big companies before they arrive. The iPhone platform is no exception.

Despite the fact that the App Store is now maturing, reaching its two year anniversary this summer, we are encouraged that native iPhone application developers are still relevant, representing 20% of the heritage pie, the second largest category. This means that the barrier to entry is still low enough for start-ups to enter and innovation to flourish. However, those days may be numbered as “discoverability” has become a significant issue, and now “marketing muscle” is starting to count more in the App Store. This favors brands and larger companies with resources to spend their way in. We are seeing signs that big brands are becoming more active, now perceiving that the iPhone has reached critical mass. With iPhone and iPod Touch now exceeding 70 million units world-wide, we expect 2010 to be the year of brands entering the iPhone. Going forward, we will especially see more movement by established brands from media, retail and CPG. In particular, traditional media (News, Books, TV, Film, Music, etc.) growth will accelerate aggressively with the introduction of the iPad.

The first and third largest heritage categories, Online and Traditional gaming, will likely see little change, or perhaps even a decline in “heritage share,” since they were early iPhone entrants and their properties have largely already discovered.

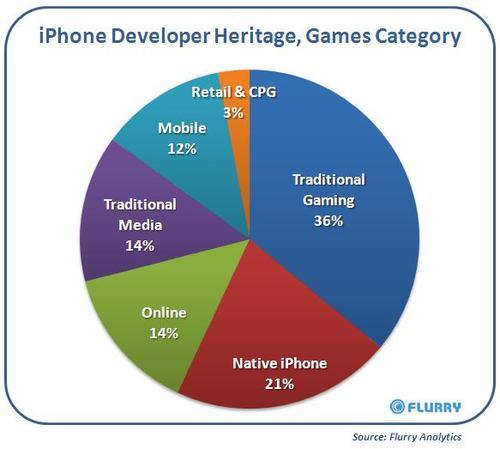

Taking a deeper look at gaming, the iPhone’s largest revenue generating category, shows the following distribution of developers based on heritage:

Given the specialized skill-set required to build a compelling game, it’s no surprise that traditional game companies lead this category, including companies such as Electronic Arts and Activision. At the same time, native iPhone developers (i.e., brand new gaming start-ups) command the second largest category. The success of new iPhone game developers makes sense given the fact that the traditional gaming industry has long had pent up demand from garage and independent developers looking for new platforms where development and distribution costs allow them to compete. We’ve seen innovation from companies such as Tapulous, Backflip Studios, ngmoco and others. Online, the third largest segment, includes companies such as PopCap, Playfish and Zynga who have naturally expanded distribution to iPhone given its similar characteristics of being “casual gaming” friendly. Tied for third with Online, Traditional Media (e.g., licensed properties like SpongeBob and Disney Fairies) have long held a place in gaming since brands seek to use the gaming channel to promote their core properties (e.g., upcoming movies) and earn incremental revenue. The most surprising category is mobile gaming which only commands a 12% share. However, investigating more deeply reveals that most successful companies on mobile, prior to the iPhone, did not originally start on mobile. Rather they came from traditional gaming, online and traditional media platforms. Simply put, few pure-play mobile gaming start-ups exist. Some exceptions include Gameloft, Glu Mobile and Digital Chocolate.

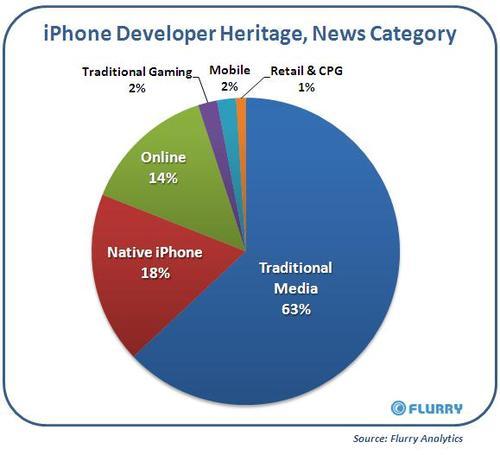

Finally, we examine the News Category more closely:

Like gaming, the creation of compelling content in News is a specialized and costly operation. To source and report quality news, companies often have to span various media such as TV broadcast, radio and print, which further increases cost. It’s therefore no surprise that Traditional Media dominates the News category, controlling nearly two thirds. For traditional media (e.g., New York Times, ABC News, NPR, etc.), the iPhone represents a large channel through which to distribute their existing content. The small incremental cost of expanding the distribution of Traditional Media’s core content, and the attractiveness of reaching an educated, affluent and tech-savvy audience, makes iPhone the perfect platform through which to serve news. Looking forward, the iPad creates an even greater opportunity to increase reach because its larger screen size works better works for newspaper and magazine layouts, as well as TV broadcast.

Native applications represent the second largest category, due to innovation from native iPhone applications that allow personalized filtering, automatically work around gaps in connectivity to pull new content more seamlessly or aggregate and optimize new reading on the iPhone (e.g., Stitcher Radio, Byline, Conserva, etc.). Online, which represents a large share of news consumption in its own right, makes up the third largest category of news on the iPhone.

Finally, while Online is currently in 3rd, we believe the iPad’s form factor will deliver a more familiar browsing experience. With ever-increasing wifi coverage, online media players will continue to increase their share just as the Internet cannibalized Print media in the 1990’s and 2000’s.

III. iPad Anticipation Continues to Stoke Developer Activity

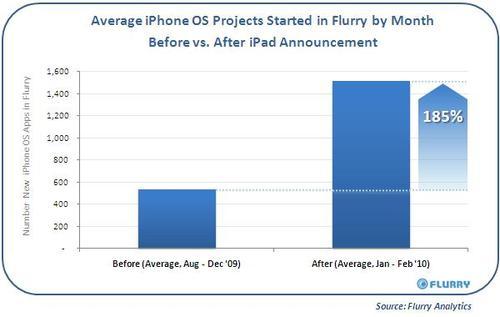

After measuring that developers integrating Flurry analytics into iPhone OS applications in January increased by nearly three times over December, we were eager to follow up on this trend after February data rolled in. The January spike represented the single largest spike in Flurry history. Since iPad runs on a version of iPhone OS, Flurry automatically supports iPad applications (and we’ve done further testing on the SDK to verify this). This is also how Flurry was able to seeapplication activity on the iPad since last October.

Now, over six weeks since Apple announced the iPad, Flurry continues to measure a significant increase in iPhone OS new application starts within its system. To measure, we took a “before vs. after” snapshot of monthly iPhone OS project starts in our system (iPad runs on iPhone OS 3.2). For the “before” we averaged August - December, 2009 monthly new iPhone app starts within Flurry, and for the “after” we did the same for January - February, 2010.

Historically, we’ve seen development spikes around new hardware announcements and releases including Motorola Droid for Android development and iPhone 3GS for iPhone OS development. iPad appears to be having a similar, albeit amplified effect, which we attribute to the excitement generated by the impending launch of of the device, now set for April 3 in the U.S. A large proportion of the applications we are seeing are custom ports of existing applications tailored for the iPad. With over 140,000 applications in the App Store, developers who modify, or build from the ground up, their applications early on for the iPad may have the opportunity to establish an early presence on this new device and drive more downloads. To wit, Apple announced today that it will include a dedicated “iPad” app category in the App Store.