The data in this report is computed from a sample size of over 1,600 live applications and 60 million consumers across four platforms: Apple (iPhone and iPod Touch), Google Android, Blackberry, JavaME.

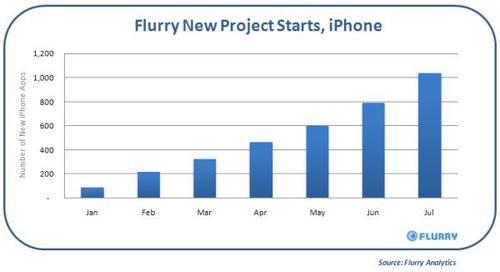

Just as “New Housing Starts” is an important indicator in the US economy, we believe “New Project Starts” among developers using Flurry Analytics provides a reliable supply-side indicator for the App Store economy. Since Flurry Analytics often is integrated early in an application’s development cycle, as early as six months before a new application ships, measuring this statistic tracks the strength of the application pipeline heading to market. Specifically, it measures 3rd party developer support for the App Store, a key to Apple’s iPhone strategy, and support which has been increasingly sought after by companies like Google, RIM and Palm.

Over the last six months, the number of available applications in the App Store has more than doubled, from 25,000 applications in January to over 65,000 in July, which equates to 14% month-over-month growth. Flurry’s month-over-month rate for New Project Starts has been holding steady at 30% for the last several months. Assuming that roughly half of those new project starts are for new applications, the pipeline to the App Store shows no signs of slowing. At this rate, by the end of 2009, the App Store will easily surpass 100,000 apps. To put this in context, the App Store soon will carry more items than the world’s largest retailer, Wal-Mart, which merchandises about 100,000 items per store.

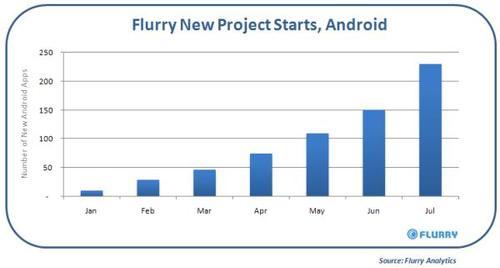

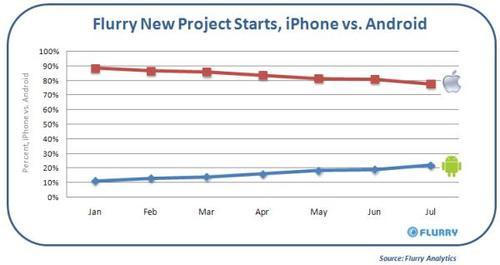

iPhone growth has been nothing short of spectacular, propelling Apple to an early and seemingly insurmountable lead over all other smart phone rivals. Looking across the competitive field, Android, with its touted open platform, appears to have the best chance of mounting a comeback against Apple’s infamously closed platform. In no uncertain terms, many are comparing the Google vs. Apple showdown to the PC vs. Mac wars of the 80s. With a wave of 18 more Android handsets shipping in 2009, the chase pack is growing and looking for signs of fatigue from the leader.

As it does for iPhone, Flurry tracks developer interest in Android by monitoring “New Project Starts” in its analytics system. While iPhone new projects have steadily increased by 30% month over month, Android’s growth rate is accelerating, increasing by over 50% from June to July alone. Though iPhone still commands the majority of developer interest, Android is beginning to close the gap in an undeniable way. The chart below compares iPhone vs. Android share of new application starts in the Flurry system, showing distinct, early signs of convergence. In total, the percent of new Android applications integrated, relative to iPhone, has more than doubled over the past six months.

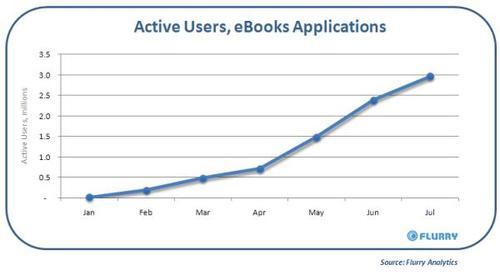

The iPhone and iPod Touch have become impressive portable media centers. Extending on the functionality of Apple’s first media business, iTunes, the iPhone acts as a fully functional iPod, playing music as well as showing movies. Somewhat unexpectedly, the iPhone and the iPod Touch have been heralded as killer gaming devices, suddenly creating formidable competition for both the Sony PSP and Nintendo DSi. However, most surprisingly, we have observed that just behind the largest category, games, eBooks has emerged as a strong second.

Examining active user sessions tracked by Flurry within the eBooks category, the chart above shows steep growth, over 300% from April to July. In July, Flurry tracked nearly three million active users in the eBooks category, or 1% of the US population. According to Apptism, an App Store tracking service, eBooks represents the second largest application category in the App Store with 14% share, only behind Games, which comes in at 19%.

With Amazon investing heavily in Kindle, iPhone has quickly emerged as a direct competitor in the eBooks category, further demonstrating the impressive reach of Apple across all digital media.