In the past 18 months, Android has emerged as a major gaming platform. Yesterday at GDC in San Francisco, we unveiled that over 70% of all Android devices engage in at least one gaming app per month. On the Flurry platform alone we see over 525 million worldwide Android devices actively engaged in mobile gaming each month. But the perception is that iOS is the more mature ecosystem and that Android is still sorting itself out, especially around business models. As we have done with the iOS platform, today we unveil the retention matrix for Android, which we hope is a helpful reference and guide for developers.

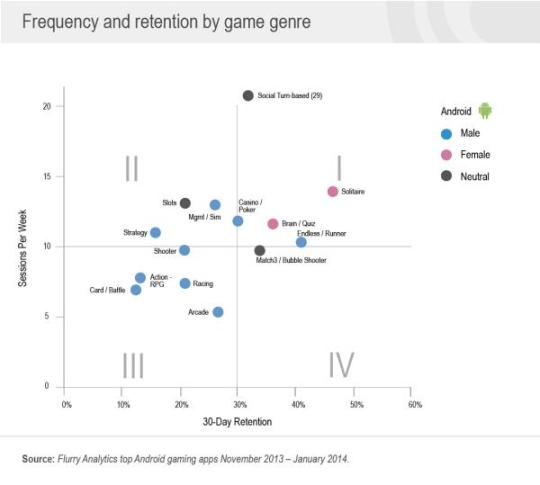

Let’s take a look at the retention matrix for 1,382 of the top gaming apps for Android. On the X-axis is 30-day Static Retention, as defined as the percentage of new users who opened the app 30 days after install (this is not to be confused with Flurry’s Rolling Retention, which looks at the percentage of new users who open the app 30 days or later after the install). On the Y-axis is the average sessions per week for that genre. The genres plotted on the chart have been manually curated by Flurry and reflect the game mechanic of the apps.

Quadrant I houses those evergreen genres that are most likely to keep their users highly engaged for long periods of time, and are typically dominated by advertising. These easy-to-play, repeatable games have strong staying power, as evidenced by their high retention. According to Flurry data, good ol’ Solitaire is the game that never gets old, with the highest retention of any genre at 50%. Not surprisingly, Social Turn-Based games have the highest session frequency and high retention given their social nature. Successful apps in this genre have built in appointment mechanics, requirements that a player return to the game in a certain time period to gain a reward, which are critical to get those high frequency and return metrics. Genres in Quadrant I are particularly amenable to ads as they have the potential to generate a very high impression count over time given their high frequency and retention rates. It’s not uncommon to see advertising generate 90% of these games’ revenue.

At these retention levels, re-engagement marketing becomes compelling, as there is opportunity to recapture users who are likely to stick around for another long spell. Since we know the peak usage for the average game only lasts two months, re-engagement is very important for these titles. Evergreen genres are also great games to use as a platform for promoting your other, higher ARPU (average revenue per user) titles.

Games in quadrant II have high frequency but lower retention rates. In other words, they’re used often but for limited time periods. This implies that those users who do stick around will be highly engaged. To maximize revenue in genres like management/simulation, slots, and strategy, tip the balance towards IAPs, as these players are willing to pay good money for content and capabilities. But don’t ignore the significant percentage of players who won’t pay. Use rewarded video ads to get the non-payers to engage more with the game by letting them earn the currency they value.

In these genres, take advantage of this intense play with offers and new content early and often (and at times of key emotional investment). Content releases need to be complete, submitted, and ready near initial push of the game, as players won’t stick around for improvements.

Genres in Quadrant III have relatively low retention and frequency. These genres have the pickiest audiences, but those that stay…pay. Like Quadrant II, focus on IAP and use video ad opportunities to monetize those users who don’t pay but want to continue playing. Well-spaced interstitials that are not too disruptive are another good choice for these genres. Developers should look to maximize revenue early in the lifecycle of game.

For these low-retention genres, it can be difficult to find right kind of user. What are known to be the highest ARPDAU (average revenue per daily active user) categories (Card-Battle and Strategy) have low “loyalty” – this is in part due to heavy marketing despite only a niche audience being interested in the genre. It’s worth the broad marketing for some of these games because when they do find a good user it is highly valuable. That said, targeting by age, gender, and persona can improve efficiency.

Quadrant IV, like Quadrant I, houses genres with extremely high retention, but relatively lower frequency. Match 3/Bubble shooter and Endless Runner genres are on the border here. We say “relatively” lower frequency as these games are still played at least once a day on average. Monetization strategy tips slightly more towards advertising given the high number of impressions generated over time. Of course, if you’ve got a hit like Candy Crush, the game can monetize quite nicely through IAP.

The first step in monetizing any app is acquiring new users. To understand whom to target, we next looked at the age and gender distribution of our game genres. On the X-axis is the average percentage of MAU that is female and the Y-axis is average age of MAU in the genre.

Not surprisingly, Android skews male and younger. Most Android genres appeal to males under 35, suggesting there’s an opportunity for an Android game that appeals to older males. Solitaire and Slots are the only genres that have a firm middle-aged audience, with Solitaire skewing more female.

Games that monetize through IAP, such as Card/Battle, Strategy, and Action/RPG titles, are more appealing to men. Genres more appealing to women- Solitaire, Brain/Quiz- are those that are more amenable to monetizing through advertising. Of course, there are always exceptions and hit titles generally figure out how to make both men and women pay.

There’s a player for every Android game. And for every game there’s the perfect mix of IAP and advertising to make it a successful business. If the game has the potential to generate high levels of impressions- either through high frequency, retention, or both- consider some form of advertising. If the game appeals to the few, the proud, the payers- focus on IAPs. Whatever the monetization strategy, target your acquisition efforts to find the right player.