The popularity of iOS and Android gaming is driving among the largest disruptions in video game history, already eclipsing portable platform gaming revenue. With low barriers to entry and potent revenue generation possibilities across more than 500 million active iOS and Android devices in the market, casual gaming is reaching new heights on mobile.

In this report, Flurry compares traditional versus independent game companies in the new mobile app marketplace. To set the stage, let’s get a current read on which kinds of apps consumers use most.

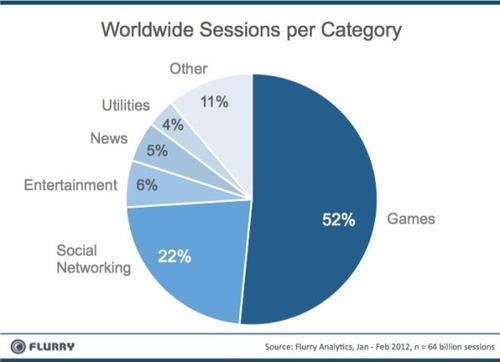

Gaming Dominates Mobile App Usage

For the first two months of 2012, Flurry Analytics measured that more than half of all end user sessions were spent in games. Across January and February, Flurry observed sessions across a sample of more than 64 billion applications sessions across more than 500 million iOS and Android devices. In addition to the snapshot above, we lay out the trend in app session growth over the last three years.

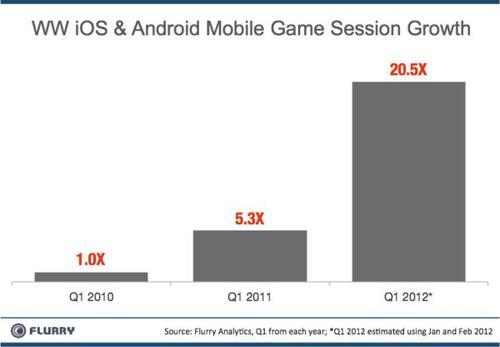

The above chart compares normalized game session levels seen in 2010 versus 2011 and 2012. We did so by first taking game sessions tracked by Flurry Analytics in Q1 of 2010 and setting that as a baseline. We then compare gaming sessions observed in subsequent years against the 2010 baseline. By our calculations, 2011 and 2012 gaming session grew by 5.3 times and 20.5 times, respectively, over the level observed in 2010. Note that we use the first quarter of each year, extrapolating Q1 2012 from January and February of this year.

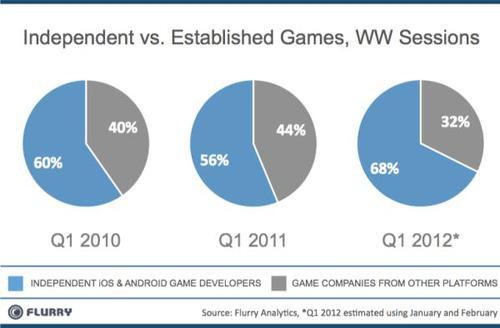

For the above chart, Flurry separated game sessions between indendent game developers who started their businesses on iOS and Android versus established gaming companies who extended to iOS and Android from other platforms. Starting from the left, in 2010, we see that about 60% of all mobile game sessions occurred in games built by independent studios. In 2011, this figure declined slightly to 56% primarily due to a wave of consolidation by established game companies who acquired independent studios (e.g., EA acquiring Chillingo, Zynga acquiring Newtoy, DeNA acquiring Ngmoco and Gameview, etc.). However, in 2012, another larger wave independent companies appeared to emerge, overwhelming established companies once again, pushing indie game session share to 68%.

Historically, the video gaming industry has been ruled by brands and established IP from a few major game publishers such as Electronic Arts, Activision, Ubisoft, THQ and others. High production, marketing and distribution costs created formidable barriers to entry. High retail price points created risk for consumers to try new titles with which they were not familiar. For these reasons, brands published by larger companies dominated the landscape.

With Apple and Google entering the ecosystem, the rules of competition have changed dramatically, arguably creating the most open, egalitarian market in the history of video games. Flurry first wrote about this phenomenon in 2009 in a series entitled The Rise of the Middle Class. While we would have expected indie game developers to fare better early on in the history of iOS and Android mobile app platforms, it’s remarkable that their dominance has grown over the last several years, with no signs of slowing. Even when traditional, established game companies have attempted to buy a stronger position on iOS and Android through acquisition, the reduced importance of brand power in mobile app gaming allows indie developers to continue to innovate and capture increasing consumer mind share.

In the new smartphone app economy, Apple and Google have truly empowered indies to thrive. And among indies, game developers are thriving the most.