With the frenzy created by the speed and price for which Facebook bought Instagram, app entrepreneurs and investors are excitedly looking for where consumers will next flock within mobile apps. In a recent report, Flurry quantified the dramatic increase in usage among social networking apps on smartphones. For the first time since the App Store launched in summer 2008, the Games category found itself rivaled by another category in terms of time spent in apps. The rise in popularity of apps like Instagram, Path and Skout signals a new era of content consumption on mobile phones where consumers are finding new, compelling ways to spend their time beyond just games.

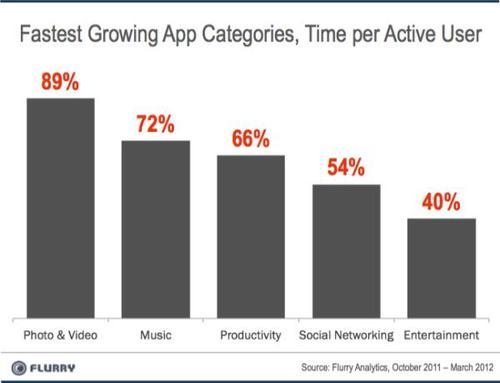

This report reveals emerging trends in mobile app category usage. By studying how consumer time is shifting across app categories, we provide an early, clear demand signal. In other words, we see where consumers are spending an increasing amount of time in apps beyond Games and Social Networking to show what’s next in mobile app popularity. For this study, Flurry leverages a sample of 8 million active mobile app users across all app categories. Flurry Analytics tracks more than 180,000 applications for more than 67,000 companies across iOS, Android, HTML5, Windows Phone and BlackBerry. The chart below shows the fastest growing app categories based on where consumers are spending their time.

The above chart shows the top five app categories based on growth in minutes spent from October 2011 to March 2012. Starting on the left, the Photo & Video category has grown the most, by 89%, in minutes spent per active user. Music, Productivity, Social Networking and Entertainment round out the top five with growth of 72%, 66%, 54% and 40%, respectively. These categories represent the fastest growing categories in mobile apps over the last 6 months. When considering what’s hot beyond the gaming category on mobile, this gives us a strong indication. Beyond the topical Instagram success story, chances are that future hits are among these categories. Some apps with momentum today include Path, Skout, Viddy, SocialCam, Evernote, Spotify and more. Please note that for iOS and Android, Flurry looks at equivalent categories (e.g., Photos & Videos in the iTunes App Store vs. Media & Video on Google Play). For all charts we use iOS category names.

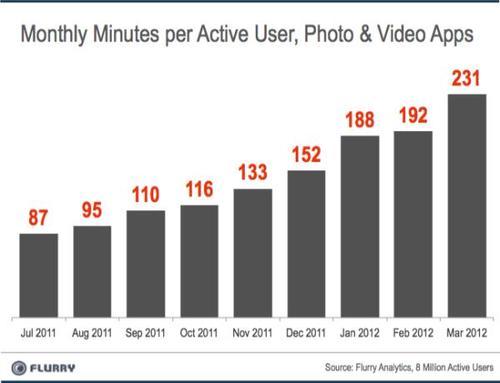

We next drill down into the Photo & Video app category to better understand growth in this category. Expanding the time range in this chart, we show the number of minutes spent by active user per month from July 2011 through March 2012.

The “overnight” sensation of video sharing apps like Viddy and SocialCam has actually been more like a 9-month tsunami gaining power. Looking at growth from July 2011 to March 2012, time spent in Photo & Video has grown by 166%. Video sharing apps offer a compelling benefit to consumers, allowing them to conveniently capture, edit and share videos on-the-fly using the powerful mobile computing devices in their pockets. Trained by the sharing behavior of Facebook, and enabled by a confluence of underlying technology like built-in HD video cameras, hardy on-device processors, increased network bandwidth, cloud storage and user-friendly applications like Viddy and SocialCam, social video apps are taking off. It’s a meaningful example of the unique innovation possibilities afforded by mobile apps.

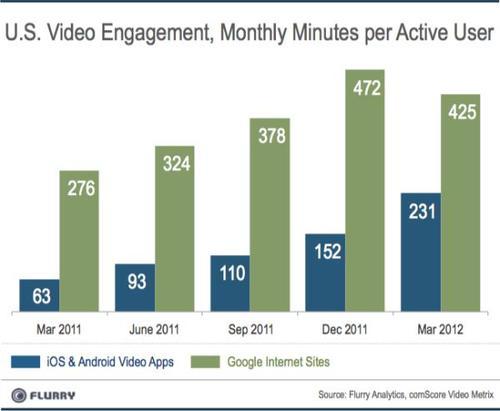

Back in 2006, Google acquired the buzzy YouTube for $1.65 billion after its own Google Video service could not keep pace. Now it appears new “cool kids” in the form of Viddy and SocialCam threaten to disintermediate the web juggernaut’s acquisition. In a recent Forbes article, Eric Jackson laid out a hypothesis that the new breed of social companies, typified by Instagram, view mobile as their primary, often exclusive platform. “They don’t even think of launching via a web site. They assume, over time, people will use their mobile applications almost entirely instead of websites.” He concludes that “we will never have Web 3.0, because the Web’s dead.” Just consider that it’s now possible to capture, edit, share and view engaging, meaningful videos among friends, all from your phone, without ever touching a computer. In this perspective, a threat to YouTube begins to feels real.

To generate a comparison between mobile app and Internet video consumption, Flurry combined its data set with publicly available comScore Video Metrix data. In the chart above, we show the number of minutes consumers spend per month using smartphone video apps versus Google Sites on the Internet (primarily YouTube). Over the course of 2011, minutes spent viewing video content online grew from 276 minutes to 472 minutes, or 71%. Over the same time period, video apps grew from 63 minutes to 152 minutes, or 141%. While mobile app video consumption grew more than online consumption, the gap in usage at the end of 2011 was still meaningful. During 2012, however, is where things get interesting. As online video consumption dropped by 10%, mobile app video consumption increased by another 52%. By then end of March, consumers were spending 54% of amount of time in mobile video apps compared to Google Sites online, 231 minutes in apps versus 425 minutes online.

While it cannot be concluded that mobile video apps are cannibalizing YouTube, the shift in time spent between these two platforms appears to be a signal of disruption. Think of it this way: With every mobile video you share of friends, family, vacations, parties and weddings, you are likely loading another bullet in the chamber for Web 3.0. For YouTube, it appears they need to run, outrun your gun.