The iOS and Android app economy continues to grow, with freemium games leading all app revenue models, now accounting for more than 65% of app revenue.

In its most recent analysis on freemium games, Flurry revealed that the amount of time and money consumers spend varies significantly by age. Younger consumers spend a lot more time, but older consumers spend a lot more money. In this post, we shift our focus to understand how freemium consumer behavior varies between men and women. We’ll compare differences in time spent, money spent, transaction volume and average price per transaction.

And since the world of marketing and advertising traditionally looks at consumer behavior by “demo” (i.e., the market broken down by demographics of age and sex), we likewise present all of our findings by demo. By Flurry’s calculation, the freemium audience represents among the largest and most attractive concentrations of educated and affluent consumers in consumer technology today. From conversations Flurry is having with the industry, brands and advertising agencies continue to show increasing interest in accessing this audience.

This study uses data from a sample of iOS and Android freemium games with over 20 million users across more than 1.4 billion sessions gathered from Flurry Analytics, which tracks over 110,000 apps across the major smartphone platforms. The amount of money spent was tallied by summing the total transactions multiplied by their respective price points. Time spent was observed by tracking the total minutes spent playing these games. Let’s start by looking at time spent. Please note that figures presented in charts have been rounded up to nearest whole percentages.

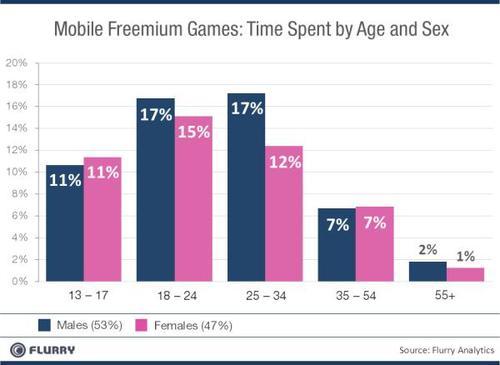

The chart above shows a graphical cross-tabbed view of time spent by age versus sex. Adding up all the percentages across each column totals 100%. Blue columns represent males and pink columns represent females. The amount of time spent by males and females is broken down by age group, from youngest to oldest, left to right. The total split of time spent is presented in the legend, with men edging out women 53% to 47%.

What we take away from this chart is that time spent in freemium games on mobile is relatively evenly split among males and females, with 18 -34 males (coincidentally considered the best target for hardcore games) representing the largest group about a third of all players. 18 – 34 year old girls come in accounting for 27% of time spent. In total, freemium gamers tend to be younger, with 83% of them under 34 years old.

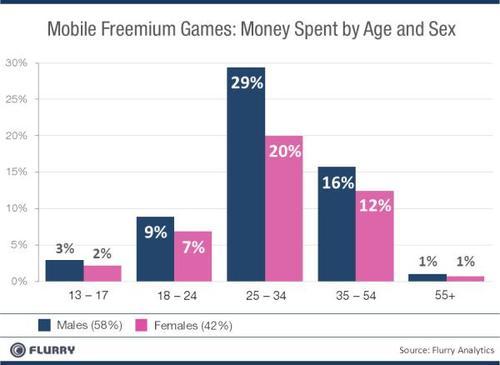

Switching our attention to money spent in freemium games, males lead in money spent by a greater degree, accounting for 58% of total money spent. Across each age group, men lead women in spending, with the greatest difference occurring in the 25 – 34 year old age group. For freemium games, spending is concentrated between the ages of 25 - 54, with men in this age range representing nearly half (45%) of spending and women representing another third (32%).

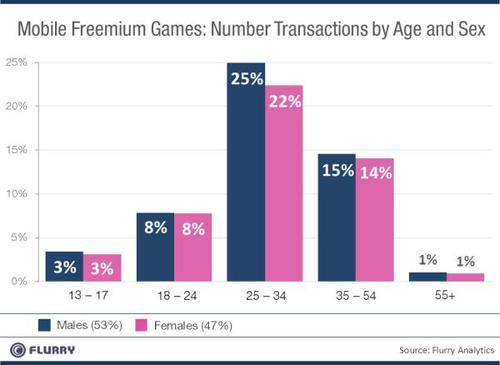

After finding that men and women spend similar amounts of time playing freemium games, but that men out-spend women 58% vs. 42%, we further drilled down to understanding this difference. Breaking out the number of transactions by demo, we see the similar clustering of transactions into the 25 – 54 year old span of users, but see that transactions are more evenly completed by both men and women. In this age range, men drive 40% of transactions and women drive 35%. This is quite a bit different than total money spent by this age group, which came in at 45% male versus 32% female.

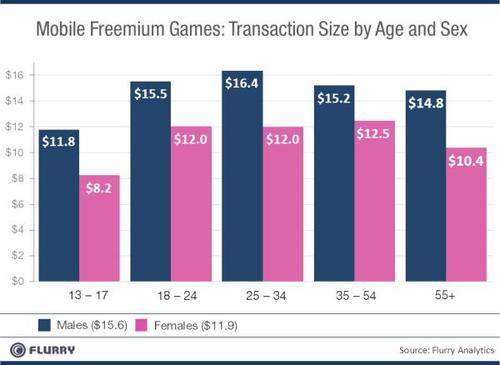

Calculating and presenting the data by amount paid per transaction, we find our answer. Men spend an average of 31% more per transaction, or $15.60 versus $11.90. In fact, male spending dominates female spending across each age group by a relatively consistent margin. In the “sweet spot” of revenue generation, 25 – 34 year olds, representing a whopping 49% of total revenue, men out-spend women by 37% per transaction.

Flurry believes that, aside from the raw appeal of a game, the ability to measure and act on this kind of data will make the biggest difference to the success or failure of freemium game companies. Zynga, who is poised to have one of the most successful IPO’s in history, recently described itself as “an analytics company masquerading as a games company.” Segmenting and targeting an app audience will reveal where to spend precious company resources to attract, retain and monetize the most valuable consumers.

In turn, advertising agencies and brands increasingly want to reach this new mass-market audience, who now spends more time in apps than browsing the web, and is primarily concentrated in freemium games. The ability to describe this audience by demo will make the difference between whether or not Madison Avenue can work with game developers. And since only 3% of consumers spend on freemium games, companies that monetize the other 97% of the audience, non-payers, will additionally succeed.

Flurry believes that the industry is at an exciting juncture, in terms of mass-market viability, real consumer spending and the ability to segment and target audiences. We know one thing for certain: companies follow consumers because consumers have money. And consumers are now in mobile apps, especially freemium games.