Hardcore Gamers are so 2007

As the growth of iOS and Android mobile devices continues to explode, there is a tectonic shift in the landscape of video gaming, a medium that continues to reach the most powerful spenders in the economy. Not only are these emerging platforms attracting droves of existing gamers, but also spawning a new and highly engaged audience: the mass-market mobile casual gamer. The era of marketing singularly to the 18 – 34 hardcore male gamer is officially over.

Given the sheer size of the video game industry, this is a watershed moment. In January 2011, according to the NPD Group, 2010 worldwide video game revenue, excluding hardware, exceeded $15 billion. Strikingly, console game sales were down by 5% in 2010 over 2009. PC sales were up slightly by 3%, primarily due the release of the latest StarCraft installment by studio veteran Blizzard Entertainment. As Flurry described in its analysis last year, hardcore gaming is facing competition from more mass-market-friendly gaming apps on mobile devices. In particular, iOS is taking a bite out of portable platforms.

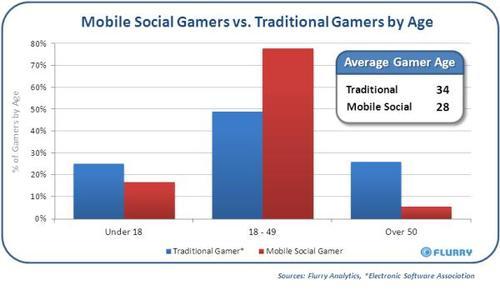

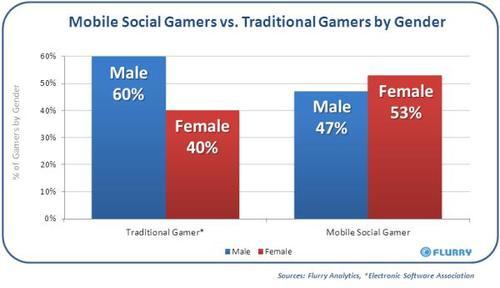

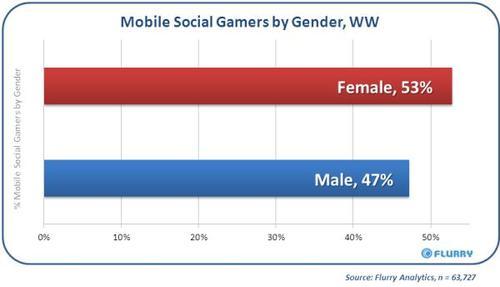

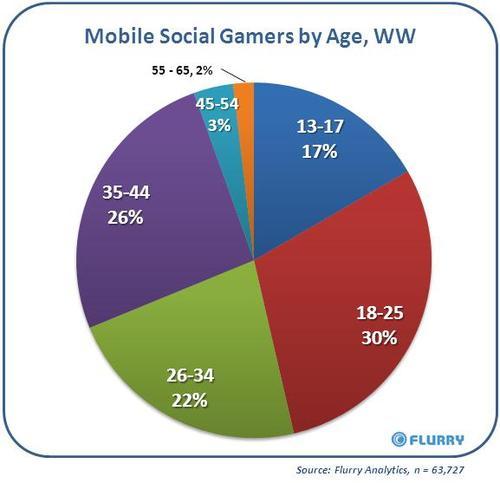

Below are two charts that demonstrate how age and gender demographics vary between the traditional gaming audience and mobile social gamers.

Reviewing the charts, it’s clear that mobile social gaming is attracting a much stronger female base, as well as a younger average user. Among mobile social gaming, there is also greater density in the 18 – 49 year old bracket, which indicates that iOS and Android devices are attracting users during their earning years versus, in particular, their teenage years, where they likely cannot afford more expensive mobile devices.

Mobile Bigger than Console, Portable… and TV

Just how big is the audience in this new era of smartphone mobile gaming? Consider that Flurry has detected over 250 million unique iOS and Android devices in the market, and is detecting more than 750,000 new devices daily. According to recent reports, this installed base is larger than the combined worldwide installed base of console industry leaders Nintendo Wii, Microsoft Xbox 360 and Sony PlayStation 3, estimated at approximately 180 million units. Likewise, iOS and Android devices command a larger installed base than the combination of portable game platforms Nintendo DS and Sony PSP, which recent estimates peg around 200 million devices worldwide.

Further sizing the segment of users that plays mobile social games, the audience exceeds that of any U.S. primetime television show, the best of which can top 20 million viewers on days airing new episodes. Contrast this to the 26 million unique users Flurry already detects 365 days of the year, and who spend more than 25 minutes per day in social games. On a broader scale, Flurry monitors more than 300 million user sessions across all games and apps. A whopping 37% of these are from games.

The Consumer behind Social Games: a Marketer’s Dream Target Audience

The audience playing mobile social games is beginning to attract the attention of major advertisers. For this study, Flurry used a sample of over 60,000 social gamers on iOS and Android who self-reported age, gender and location. For parts of this report, where we focus on the U.S. segment of the audience, we further crossed location information with United States zip codes to leverage U.S. Census Bureau data for deeper segmentation.

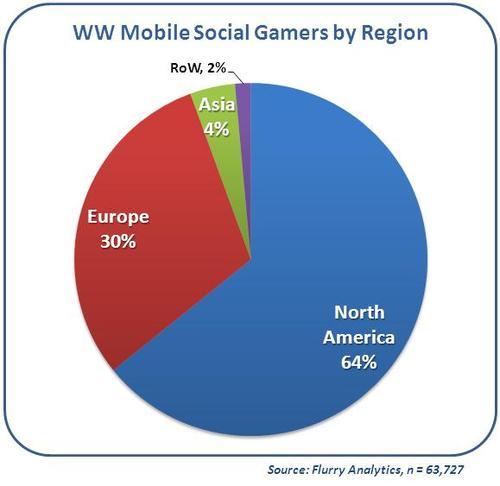

Let’s start by looking at the concentration of mobile social gamers by international region.

The chart above shows that mobile social gamers live in more developed economies, with the highest concentration in North America, followed by Europe. This hints strongly at a similar geographic footprint to iOS and Android penetration to date, with Asia beginning to grow more quickly as Android, in particular, finds increased distribution in this part of the world.

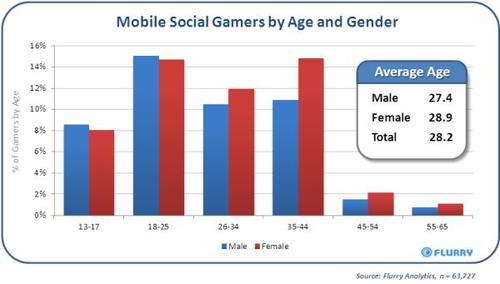

Next, we display a cross-tabulation of age and gender in a bar chart format for our worldwide sample. This provides the opportunity to study how male and female usage varies across age ranges.

From the chart above, it’s clear that female mobile social gamers are older than their male counterparts. While males have a slight lead in usage in the 13 – 25 year old range, more women play between 26 – 44 years of age. Additionally, referencing the earlier age comparison between traditional and mobile social gamers, the latter are younger, with an average age 28.2 vs. the traditional, more hardcore gamer, who is more often male with an average age of 34. Just below, we display separate charts for age and for gender.

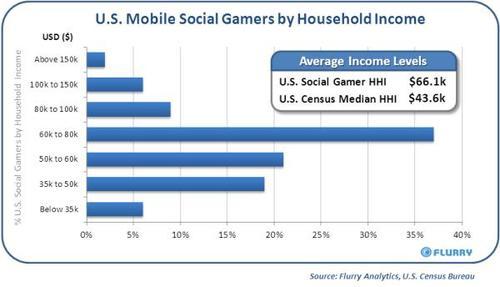

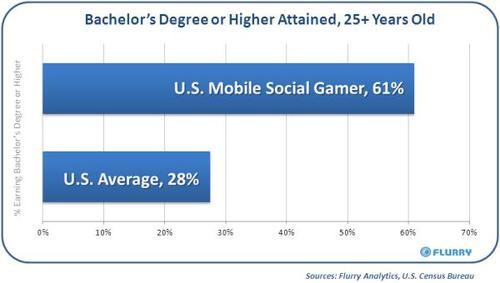

The U.S. Mobile Social Gamer: Affluent and Educated

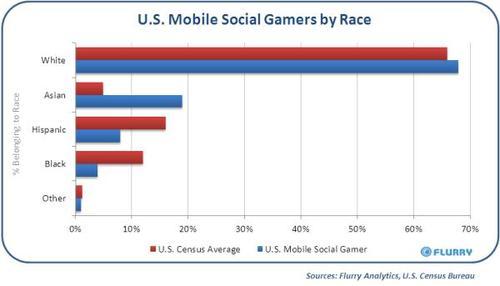

Studying the U.S. mobile social gamer, we note that she earns over 50% more than the average American, is more than twice as likely to have earned a college bachelor’s degree, and is more likely to be white or Asian.

The video game industry is transitioning from an era of hardcore male gamers who have dominated the landscape, to more mass-market usage across mobile social games. 18 – 34 year old males are being supplanted as the most attractive segment to target by big brands and agencies. The Mobile Social Gamer segment is highly engaged, younger, made up of more females, more educated and more affluent. In terms of usage behavior, they use social games far more often than they watch prime-time television shows, and using for 25 minutes per day, are heavy users of this interactive content. Mobile social gamers are the new mass-market powerhouse.