The iPhone App Store has changed the rules of competition for mobile application developers. Among its major achievements include granting equal access to the store for all developers, providing consumers with rich product info and free trials, and giving developers unprecedented control through app updates, marketing materials and price setting. As a result, more developers are making more money, and we are seeing the emergence of a New Middle Class.

Because of the iPhone, the days of a few established mobile companies gaining privileged access to consumers via carrier decks is ending. Still, some say larger companies will dominate the iPhone App Store now that it has proven to be a lucrative, relevant marketplace. Earlier this month, at MobileBeat 2009, a panel moderator asked “What happens now that the first wave of applications gives way to a new wave of apps from large companies?” insinuating that it’s only a matter of time before indies are overrun by the historical mobile content leaders.

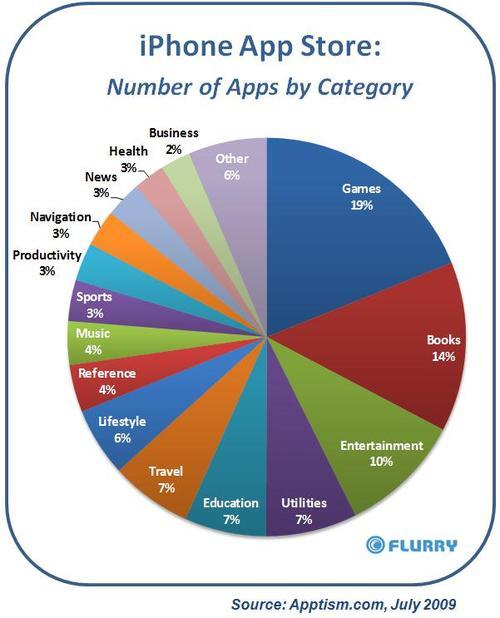

To understand the viability of the New Middle Class, we decided to compare companies and apps across Top Sellers lists on traditional carrier decks vs. the App Store. Below is the distribution of the now well over 60,000 apps in the App Store across categories. Wading through thousands of applications, we narrowed our focus to the largest App Store category, games.

With a focus on the games category, we will test several hypotheses over the next few weeks, the first of which is addressed in this blog post, that speak to the attractiveness of the App Store vs. carrier decks for indie and established developers.

Hypothesis: Based on the number of top slots occupied by established game publishers on carrier decks (e.g., Verizon, T-Mobile, Vodafone, etc.), we similarly expect established game publishers to increase their share of top slots over time in the App Store.

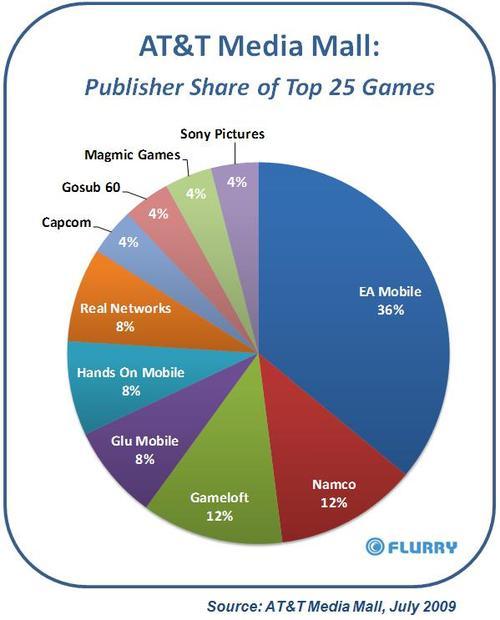

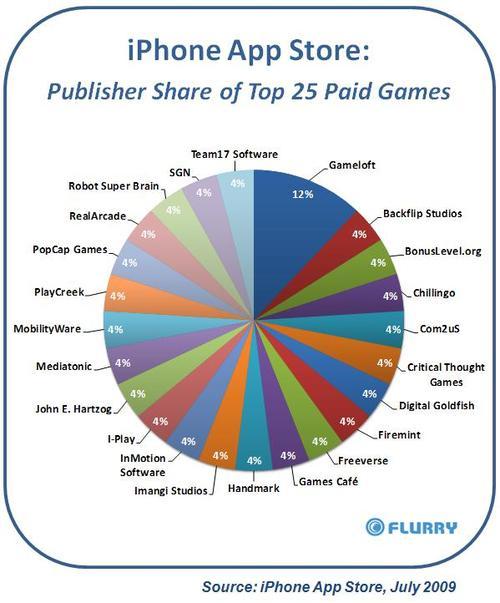

Baseline: For the month of July, Flurry took a snapshot of the top 25 selling games from the traditional AT&T storefront, the AT&T Media Mall, and compared that against the top selling games in July for the iPhone App Store. This serves to show how different the distribution of game publishers are today on the closed carrier decks vs. the more open App Store. However, this does not show any trends over time, which we explore next.

From the pie charts above it’s clear that the App Store is not only more fragmented, but also driven by new developers. The top publishers in mobile gaming that regularly dominate top slots on carrier decks do not have the same presence on the iPhone. EA Mobile is notably absent from the App Store Top 25 snapshot. However, this can be somewhat attributed to the fact that several of their titles are priced at signficantly higher price points, between $4.99 and $9.99. If we had expanded our view to the Top 50, EA would have fared better. Additionally it’s worth noting that Gameloft is trending better in this snapshot than usual, given that just before we captured this ranking, Gameloft had simultaneously dropped all of its price points, most of which were $4.99, to $0.99. This aggressive price drop spiked its sales across the board.

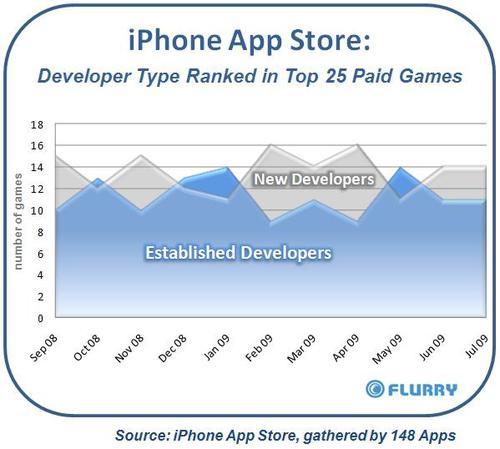

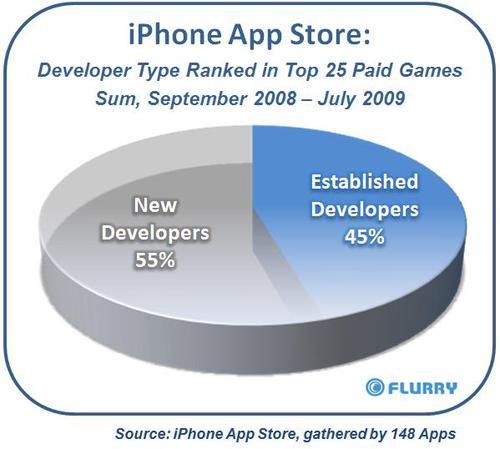

Test: To understand whether the strong showing of new developers in July wasn’t an anomaly, Flurry took a mid-month snapshot of the top 25 games from the App Store Top Paid Games category from September 2008 through July 2009. We then categorized the applications by whether they were made by established or new companies, tallied the results and generated the following charts. Note that we decided not to include free games since carriers did not offer free games at any time.

Conclusion: New game developers not only hold their own against established game developers, but also outrank them, on average, among the Top 25 games on iPhone. With speculation that more incumbent mobile gaming companies are investing more heavily in the iPhone platform, we would have expected to see an increase in the number of top slots held by established companies over the last several months. However, new developers continue to rank well. To be fair, these observations are independent of price points, and established companies tend to price higher, and hold their higher price points longer. At the same time, it’s worth appreciating that when providing consumers with ample information, free trial and abundant choice, consumers are interested in far more than simply what is offered by “The Establishment.” Independent developers tend to take more risks and deliver more innovation. In the right marketplace, the best products rise to the top, regardless of who makes them.

Continue to Part II of the New Middle Class series, where we study how well new, original apps competes against big brands.