In Part I of this series, Indie iPhone App Developers, we explored the breakdown of new vs. established developers in the App Store, focusing on the largest App Store category, Games. Evaluating over 10 months of data, we concluded that new entrants outrank incumbent mobile game developers in the top paid games category, and with no signs that established game publishers are gaining ground. We call this new group of developers the New Middle Class.

This blog post further explores how key changes in the ecosystem, driven by Apple, have enabled the growth of the New Middle Class. Simply put, a year ago, the new darlings of mobile gaming - companies like Bolt Creative (Pocket God), Backflip Studios (Ragdoll Blaster, Paper Toss), Storm8(World War, Racing Live) and Firemint (Flight Control, Real Racing) - could not have flourished in mobile.

At the highest level, this can be explained by friction points in the industry that included significant development and porting costs, impossible distribution challenges and rampant consumer risk. If a game maker did not license a big brand, they were basically dead on arrival. Very few companies, most notably Digital Chocolate, were able to survive this era of mobile, but largely due to a formidable streak of exceptionally innovative and well-made games.

With the iPhone and App Store, Apple has leveled the playing field for garage developers. In today’s mobile world, an indie game maker can invent an original game, distribute it and compete with the likes of Electronic Arts and Gameloft. In other words, content is king again, and it doesn’t need to be licensed. With that in mind, our analysis focuses on original vs. branded content in the gaming category.

Hypothesis: With reduced friction to get into the App Store, and less friction for consumers to try and buy games, original games compete more effectively against branded games in the App Store vs. carrier decks.

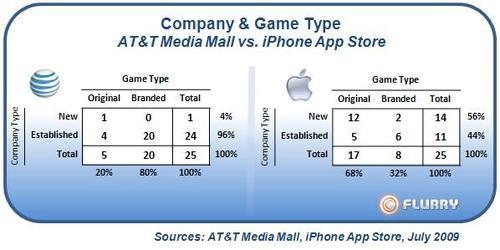

Baseline: In July, Flurry compared top selling games in the App Store vs. the Media Mall, the AT&T managed storefront. Specifically, we looked at the breakdown of original vs. branded titles, and present these in the table below.

A quick inspection reveals that branded content dominates the traditional carrier store front. Out of 25 titles, 20 of them are branded (80%). However, in the App Store, original titles hold roughly two thirds of the Top 25 slots (17 of 25, or 68%). Even more striking is a comparison of games that are both branded and shipped by established companies. In this case, we find that AT&T’s store front has 3.5 times as many branded titles by established companies versus the App Store (20 vs. 6, or 80% vs. 32%).

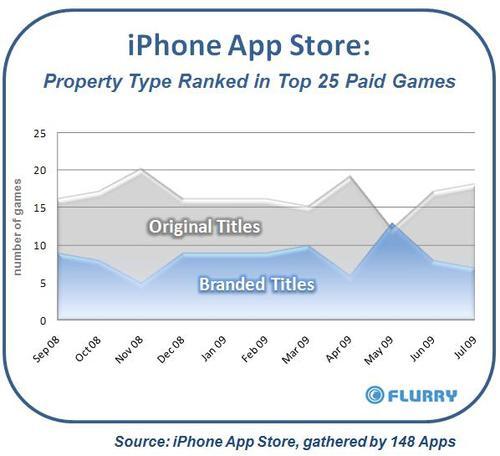

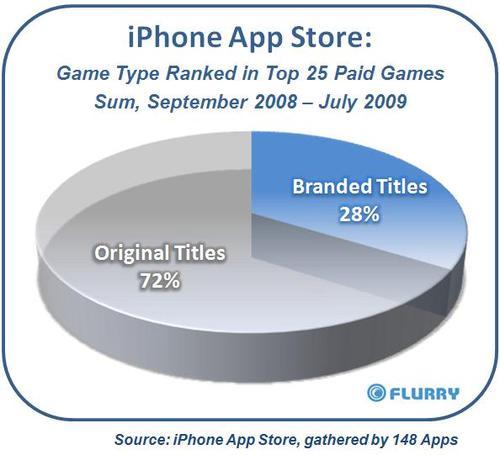

Test: To ensure July’s snapshot accurately reflect the success original games have on the iPhone, Flurry took a mid-month snapshot of the Top 25 App Store Top Paid Games category from September 2008 through July 2009. We then sorted games into two categories: (1) original titles created just for the iPhone; and (2) existing brands, whether licensed (e.g., movies, sports, music, board games, etc.) or ported from other platforms (e.g., social networks, classic arcade, web, console, PC, etc.). We tallied the results and generated the following charts.

Conclusion: When it comes to the Top 25 Paid Games on the iPhone - the largest App Store category - Original games dominate Branded games by a ratio of nearly 3:1. Further, compared to the kind of companies appearing in the Top 25 games (55% New vs. 45% Established), covered in Part I of the New Middle Class series, Original titles trump Branded titles by an even wider margin (72% vs. 28%). This can be attributed to the fact that established companies also ship original titles, and some of these rank better than their branded counterparts.

Apple can be credited with enabling the Rise of the Middle Class in two historical, groundbreaking ways. First, Apple provides the most egalitarian access for all developers who want to sell apps in the App Store. Love or hate the App Store submission process, it is worth remembering that only the most privileged, dogged or lucky companies were granted access to the carrier decks. And while the number of available games now totals more than 10,000 in the App Store, most carrier decks listed no more than several hundred games at a time, regularly sun-setting any title that “under-performs.” Second, Apple has significantly reduced the amount of risk that consumers face when trying and buying new games on the iPhone. The App Store provides rich point-of-sale information (e.g., long descriptions, screenshots, videos), has enabled free trial, provides a forum for consumer reviews and has created an efficient market whose equilibrium outputs lower price points. By stark contrast, carriers set minimum pricing around $4.99, frequently blocked free trial, provided no voice for consumer reviews, and as described above, offered minimal information about a game a consumer might consider purchasing.

The App Store has created a level playing field, enabling a steady stream developer Cinderalla stories. Unlike the carriers, previously charged with managing mobile store fronts, Apple has provided more choice to consumers while simultaneously empowering them with all the tools to make informed decisions. The resounding result is that indie developers are thriving in mobile like never before.