May 13, 2015 | Vidya Subramanian

Canada has long been an important country for app developers. It’s often where developers first launch their apps – to test and solicit feedback before distributing their apps globally. So, what makes this market unique in the mobile ecosystem? In Flurry from Yahoo’s latest report, we take a closer look at Canadian mobile usage to understand where it’s similar and where it’s different from the rest of the world.

Flurry from Yahoo currently measures 38 million monthly active devices in Canada. Given the country’s total population of approximately 35 million, this means we’re seeing more than one active device for every man, woman, and child in Canada. For this analysis, we looked at activity across 92,000 Canadian devices in March 2015.

Apps Lead the Way in Canada Too

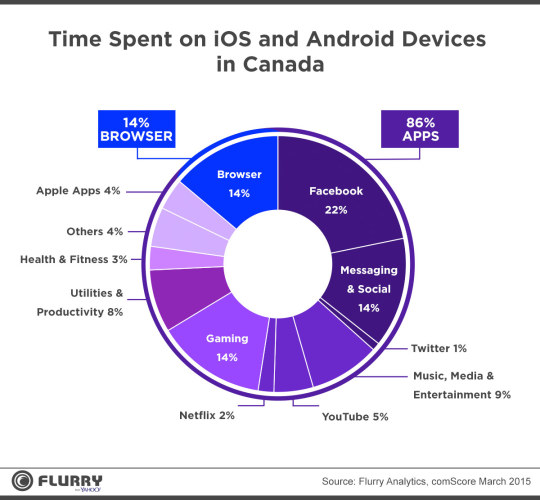

Like their American counterparts to the South, Canada is truly an app nation. Based on data from Flurry Analytics and comScore, we analyzed how Canadians spend their time on mobile. We found that in Canada, 86 percent of time spent on mobile devices is spent in apps and 14 percent is in browser. For comparison, that split is the same as what we see in the US. Canadians and Americans are in sync in their love for apps.

Canadians spent the most time in Messaging and Social apps, with Facebook leading the way at 22 percent of total time. The next largest category is Music, Media and Entertainment, where Canadians spend a combined 16 percent of total time. This is double the percentage of time Americans spend in Entertainment apps, so Canada can be a great test market for these types of apps. Another clear difference between the US and Canadian market is in the share of time spent in games. In the US, games command 32 percent of total time spent on mobile, compared to just 14 percent in Canada.

Game developers should perhaps take note: if you can create a sticky game in Canada, you’ve likely got a hit on your hands as it’s a tough crowd for games.

Canadians: Physically Fit and Crazy About Sports

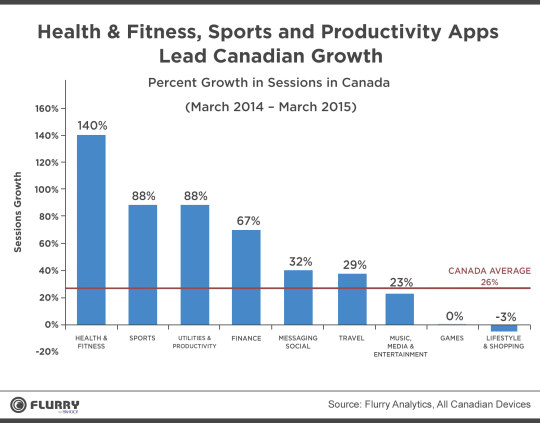

Canada is no stranger to the global growth engine that is mobile. When we looked at total session growth from March 2014 to March 2015, we found that Canada is growing at 26 percent. What’s driving that growth? Well, four categories of apps stood out – Health & Fitness, Sports, Finance, and Utilities & Productivity – all growing at least 2.5x faster than other categories.

Ultimately, Games and Lifestyle & Retail apps are not growing in Canada. The flat nature of Games growth is not wholly surprising, given the maturity of the category around the world. However, Lifestyle & Shopping is a leading growth category globally. BMO Nesbitt Burns, a Canadian investment firm, released a report last week in line with this trend, remarking that “e-commerce is more in its infancy in Canada.” They noted that the large geographic size of the country, mixed with its smaller population, may be a contributing factor.

Phablets Beginning To Take Hold in Canada

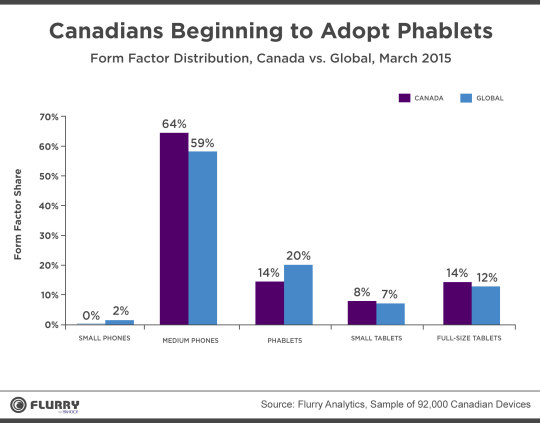

Flurry from Yahoo recently published research on the phablet, showing that it is the fastest growing device type experiencing 148 percent year over year growth. Are Canadians part of this trend? It turns out they are, though slightly later in the adoption curve.

Taking a look at form factor distribution in Canada compared to the rest of the world, we find that Canadian adoption of phablets is at 14 percent. This is lower than the 20 percent penetration of phablets globally.

The larger form factor undoubtedly lends itself to a better consumer experience with media - from hockey to news to video to games. Given the significant amount of time Canadians already spend in music, media and entertainment apps, along with the growth of session activity in sports apps, it would not be surprising to see phablet adoption continue to rise in Canada.

To Test or Not to Test: For Most Apps, Yes

Canadian engagement with mobile apps clearly has its nuances. Consumers show a particular preference for apps related to Social & Messaging, Entertainment, Sports and Health & Fitness. Developers creating apps in these categories would be well served to launch their apps in this market and reap the benefit of a deeply engaged audience. Developers creating apps in other categories – particularly Lifestyle & Shopping and Games – may still learn from Canadians, but should consider adding additional launch markets to round out their testing.