Apps are big business, and the biggest app business is games. In 2012, Flurry estimates revenue earned from apps will approach $10 billion, with games taking over 80% of the pie. The free-to-play business model (aka freemium), where consumers download and play the “core loop” of a game for free, but then pay for virtual goods and currency through micro-transactions, is the most prolific business model in the new era of digital distribution. When it comes to app consumption on iOS and Android smart devices, consumers spend over 40% of all their time using games.

The most successful companies in the new mobile economy, from Electronic Arts to Zynga and Mobage to Supercell, deeply understand consumer behavior differences by game genre. This level of understanding greatly informs a company’s app acquisition, retention and monetization strategies. In this report, Flurry examines the consumer behavior differences by app usage, retention and demographics for the top nine freemium game genres in mobile gaming. For this analysis, Flurry leveraged a sample of more than 300 million consumers using iOS and Android games each month. Please note that, for consistency, we include only free titles.

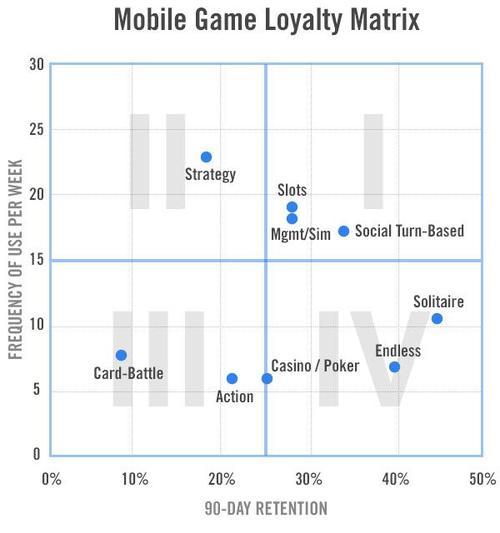

In the chart below, we lay out a “loyalty matrix” that plots the top nine freemium game categories by how often they’re used compared to how long consumers continue to use them over time. Specifically, we plot the 90-day retention rate of app categories on the x-axis against the frequency of use per week on the y-axis. We lay the “scatterplot” out in a Cartesian coordinate system with four quadrants.

Quadrant I represents a “sweet spot” for developers, whose games are used intensively by a set of highly retained users. Well-designed “appointment” mechanics drive frequency, as users are compelled to maintain and progress in their respective game. Social Turn-based games succeed in building an active, loyal user base by offering popular “evergreen” games played among friends. From a revenue perspective, while there exists significant potential to show advertising impressions to consumers who use so frequently, games in the Slots and Resource Management & Simulation (labeled as “Mgmt/Sim”) genres commonly monetize via in-app purchase. However, companies that maximize revenue in Quadrant I extract revenue from consumers willing to pay via in-app purchase, and then by showing ads to those who do not pay.

Quadrant II is characterized by the most intensive usage over a short customer lifecycle, and is occupied solely by the Strategy genre. This audience is demanding, game lifecycles are short and a game’s live services must be flawlessly executed. Successful Strategy game developers accelerate monetization by driving competition among players (“Player vs. Player”) and by encouraging fast game progress through premium currency spends. With frequency of use so high, users churn through content quickly. To maximize retention, developers must continuously release new content after the game’s initial launch.

Quadrant III also attracts a fickle gaming audience, but adds the challenge of having fewer opportunities per week to monetize the user. The well-documented success of the Card-Battle genre in Asia, and now Western markets, is even more impressive when considering the short time frame developers have to drive transactions. Targeted user acquisition is critical to avoid paying for large batches of users that will drop off quickly due to the “hardcore” nature of the content and game mechanics.

Quadrant IV features easy-to-play and highly repeatable games that can remain on a user’s “play list” for years. These evergreen titles may lack the depth required to generate sizeable in-app purchases, but do generate substantial advertising impressions over time. In addition to driving strong ad revenue, the large audience size of these games can be used to cross-promote a developer’s more narrowly focused, but better monetizing titles.

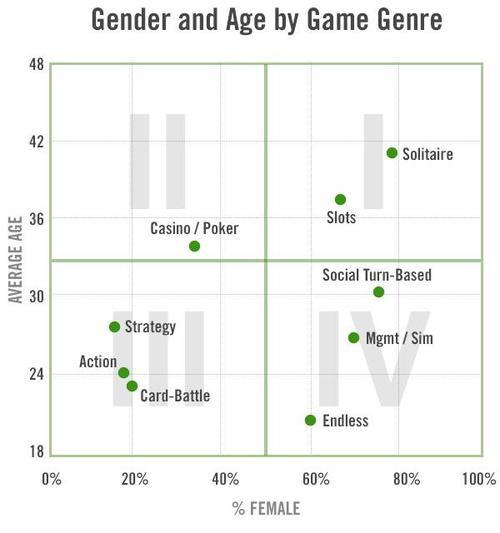

As the mobile app economy grows, the sophistication of its related advertising services will reach those found on the Internet today. Leveraging big data, the ability to target users based on demographics and personas, and then track the effectiveness of such targeting is just starting to take hold (Flurry has invested in this direction with its own services like Flurry AppCircle, an ad network, and Flurry Ad Analytics, an ad effectiveness solution). As developers and app marketing providers become more savvy, they can better acquire the kinds of users that will reliably play and pay in their apps. Below, using the same sample set of games, we look at the Age and Gender of users by genre.

A quick review shows that Quadrant I is largely comprised of middle-aged females that play games we know to have attractive retention and usage metrics.

Quadrant II shows that males are not extending into the same 40+ average age-range as female players. Casino / Poker games tend to attract older males the best.

Quadrant III is undoubtedly the hottest sector of the mobile gaming market, with young, male “core” gamers pausing their console gameplay sessions to increasingly play mobile games. These young men are difficult to corral, but can monetize at a rate that justifies the cost and effort of acquisition.

Quadrant IV shows younger females adopting games that feature more involved gameplay than those played by the middle-aged female crowd. While the youngest users enjoy the quick solo experience of the Endless genre, the late twenties / early thirties crowd are diving deeper into game mechanics and making it a social experience.

As mobile gaming rapidly matures, it is becoming increasingly difficult for new and small developers to succeed. The game quality bar has risen dramatically, user acquisition costs continue to climb and organic installs via app store discovery and featuring are harder to come by. One great equalizer for developers is the ability to collect and harness the power of data. In fact, game developers tend to be the “power users” of analytics, using sophisticated metrics to track user progress, tune gameplay and maximize monetization (a large part of Flurry Analytics’ use base is game developers). In an industry that has historically been considered more artistic and subjective, connected devices and the ability to rapidly iterate on already shipped titles has ushered in an age of science and measurement. In short, data has enabled the “gamification” of the mobile industry.