In August of this year Flurry Analytics measured 33,527,534 active smartphones and tablets in South Korea. While that was only 2.8% of the entire worldwide connected device installed base Flurry measures, South Korea is an important market for connected devices for several reasons. First, it is the first connected device market in the world to approach saturation. Second, it is Samsung’s home market, and largely as a consequence of that, more of the devices in use there are manufactured by domestic firms than is the case for any other country. Finally, it is home to more phablet fans than anywhere else.

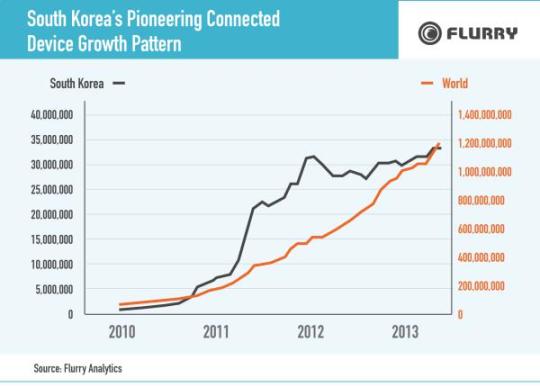

Worldwide the installed base of connected devices measured by Flurry grew by 81% between August of 2012 and August of 2013, whereas growth for South Korea during the same time period was only 17%. It was a different story just a couple of years ago. During late 2011 and early 2012, the South Korean connected device market grew more rapidly than the worldwide market, as shown by the divergence of the black line from the red in the chart below. This was the period during which Samsung introduced the Galaxy Note. It was the first successful ‘phablet’, enabling Samsung to capture two-thirds of the South Korean mobile phone market, and driving rapid growth in that market. As shown in the graph, that growth has slowed markedly in the past year or so, and has even been negative in some months. That implies that the South Korean connected device market either already is, or will soon be, the first in the world to reach saturation. As such, it provides a good early indicator of what other markets can expect once the rapid growth period the mobile market has experienced over the past few years ends.

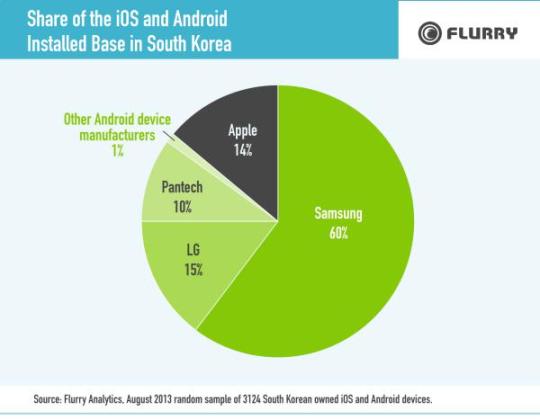

Even as growth in its domestic market has slowed, Samsung continues to dominate the South Korean connected device market. It had a 60% share of a random sample of 3,124 of the devices in our system in South Korea that run iOS or Android apps. Between them, two other South Korean device manufacturers, LG and Pantech, had another 25% of the market, meaning that the vast majority of the smartphones and tablets being used in South Korea (85% of the devices in our sample) are manufactured in South Korea. That dominance of local manufacturers is unique in the world now that Apple’s share of the US market, Blackberry’s share of the Canadian market, and Nokia’s share of the market in Finland have all weakened.

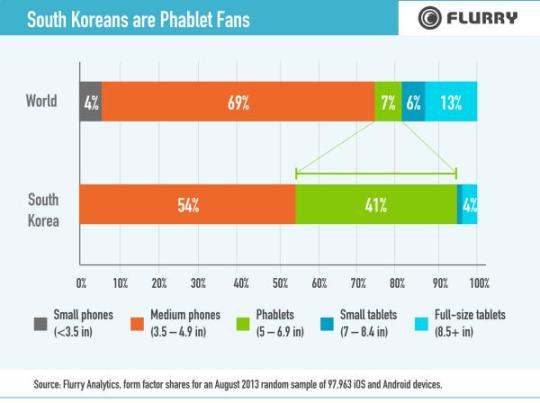

Given that South Korea’s rapid period of connected device growth was ushered in by the phablet, it is perhaps not surprising that it continues to surpass the rest of the world in its preference for that form factor. As shown below, in a worldwide sample of 97,963 iOS and Android devices, only 7% were phablets, but for South Korea that percentage was 41%. The appeal of phablets in South Korea appears to suppress the tablet market there. Worldwide, 19% of the devices in our sample were tablets compared to only 5% in South Korea.

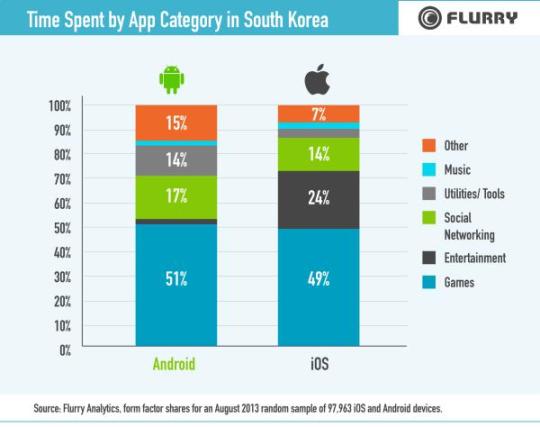

Games are the most popular app category in South Korea, as they are in much of the rest of the world. SK Planet’s T Store, the largest app store in South Korea, provided data to Flurry showing that 68% of its revenue from apps plus other digital content comes from games. On average, their gaming customers generate ₩5,657 (~U.S. $5.27) per user per month in gaming revenue alone compared to an overall average of ₩3,135 (~U.S. $2.92) per user per month in revenue across all forms of digital content for all customers.

Social networking accounts for a significant share of app activity in South Korea, as it does in many other countries. Tool apps are used heavily by South Korean Android users, and entertainment apps capture a lot of time spent in iOS apps.

Compared to app users elsewhere, South Koreans over-index on Entertainment apps on iOS and several Android app categories (Media / Video, Photography, Lifestyle, Shopping, and Tools).

As in the U.S., the vast majority of apps used in South Korea – 96% of those available through the T Store – are free.

The fact that the South Korean connected device market is saturated (or very close to being saturated) makes it an interesting test case for considering the future of the connected device market worldwide. What happens once more or less everyone who is likely to is carrying at least one smartphone or tablet?

One area to keep an eye on is new uses for connected devices, such as mobile payments. South Korea is a world leader in mobile payments – probably in part because of the prevalence of NFC-enabled devices. For example, SK Planet has a mobile payment system called T Cash, which is used for 54% of in app purchases, and also can be used to pay for off-device transactions such as train and taxi fares. Interestingly, another third of in app purchases are paid for using gift certificates, demonstrating the potential of mobile devices as a mechanism for giving and receiving gifts. It doesn’t seem like a big leap for that to go from in app purchases to physical goods that could be delivered or picked up with the mobile device used for authentication. Already merchants in South Korea are using tablets to manage payments, inventory, and even promotion.

Another area to watch is interoperability across connected devices. The fact that Samsung manufactures smartphones, tablets, and connected TVs (as well as other consumer electronics that are becoming part of the Internet of things) makes it well-positioned to better integrate those devices and the content that runs on them. With Samsung being so dominant in South Korea and that market being so well developed for connected devices, it is a logical test market for products and services that take advantage of that type of cross-device integration.