Over the past 5 years, Apple and Google have maintained a healthy duopoly in the smartphone market. Android has picked up market share dominance, especially internationally. Meanwhile, Apple has maintained a perceived lead in software and customer engagement, something many analysts refer to as the “Apple Magic”. At Flurry, we have always measured consumer engagement by the time spent in apps, which allows us to put metrics behind the “Apple Magic”.

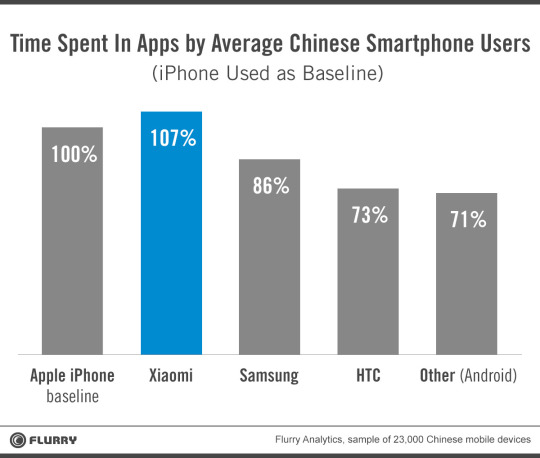

Over the past 6 years, the average Apple iPhone consumer has spent more time in apps than consumers of every Android device we track- by a wide margin. This year, it looks like the story is about to change. In an analysis we conducted on a random sample of 23,000 devices in China throughout January 2014, we found that Xiaomi is now in the lead as far as time-spent in apps is concerned.

The chart below shows the time spent by the average smartphone owner, using the average iPhone consumer time spent as the baseline. The average Xiaomi consumer spent 7% more time in apps than an average iPhone consumer. The average Samsung consumer spent 14% less time than an iPhone consumer while the average HTC consumer spent 27% less time than an average iPhone consumer. This is the first time we’ve seen an Android smartphone catch up to the iPhone’s most important engagement metric- and exceed it.

Since this is a material change, we spent more time analyzing Xiaomi device usage and also tried to understand the profile of Xiaomi consumers compared to the profile of smartphone users of all mobile users (iOS and Android). We have restricted this analysis to just Chinese users.

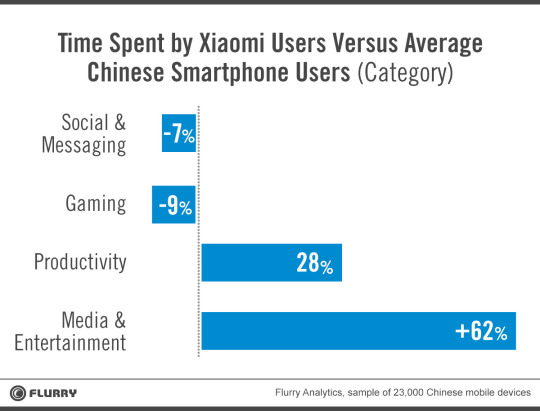

First we looked at app category. Xiaomi consumers over-index on their use of media and entertainment applications. An average Xiaomi consumer spends 62% more time in these apps than the average Smartphone consumer (again, both Android and iOS and counting all Smartphone devices). Usage of media and entertainment apps by Xiaomi consumers has been consistently high ever since we encountered the first few Xiaomi devices. While many analysts have dubbed Xiaomi the “Apple of China,” we think of Xiaomi as the Apple-meets-Netflix of China. Xiaomi consumers also over index on productivity apps by 28%. They under index on gaming by 9% and social/messaging by 7%. This is shown in the chart below.

A Clear Profile of Xiaomi Users Emerges

Then we looked at the profile of Xiaomi consumers: age, gender and Flurry Persona.

Looking at gender, Xiaomi consumers tend to skew slightly more male than female with 54% males and 46% females. This compares to 52% males and 48% females for an average Smartphone consumer, so the difference is not very remarkable. Things get more interesting when you look at age.

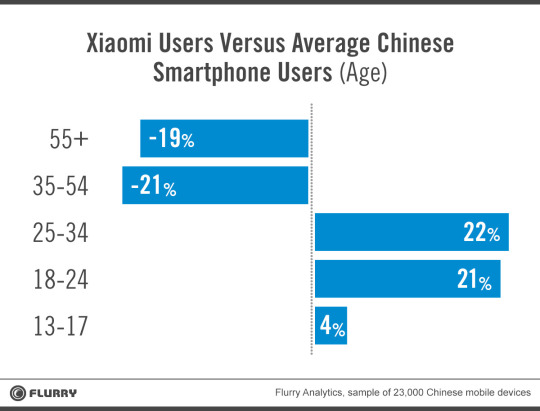

Xiaomi consumers over-index on the 13-17, 18-24 and 25-34 segments and under-index on the 35-54 and 55+ segments. This data shows that the Xiaomi devices are very popular among the young population of China, especially college students and young adults who just entered the workforce.

The analysis of Xiaomi consumer Personas gave us a much better insight into their profile. Xiaomi users over-index on the Business Professional Persona by a large factor. They also over-index on the Parenting and Education Persona, as well as the Fitness Enthusiast Persona. They tend to slightly under-index on Gaming.

This analysis is giving us a clear image of Xiaomi Chinese consumers. The data is pointing towards young business professionals, most likely college-educated. This is a fast growing segment in China and a main driver behind China’s new consumer-driven economy. This year alone, 7 millionChinese will graduate from college, up from 1.1 million in 2010. By 2020, China’s college educated talent pool will exceed 195 million people, more than the entire U.S labor force that year.

Many analysts compare Xiaomi consumers to Apple “fanboys” who have a strong loyalty to the brand. A frenzy ensues when new Xiaomi models are released online, and some of them sell out in minutes if not seconds. In fact, the Mi3 sold out in 17 minutes when introduced in Singapore. But many analysts doubt Xiaomi’s ability to compete long-term with deep pockets and established manufacturing might of Korea’s Samsung and China’s Huawei. The jury is still out, but it sure looks like Xiaomi picked itself a very interesting segment to pursue and secure: China’s young business professionals, the anticipated engine of world’s second largest (and soon to become first) economy.